All eyes are focused on the drama playing out in Greece. The Greeks have just voted not to accept Europe’s latest offer to keep the credit flowing, amounting to a 5% of Greek GDP income transfer from their European neighbors, in return for additional economic reforms to put the country on a path to self-sufficiency.

The New York Times declares, “For Europe’s Sake, Keep Greece in the Eurozone,” that the European Union should “offer some path forward for the Greek economy, starting by writing down its huge and unpayable debts.” More than likely EU leaders will work out a new agreement with Greece to enable it to remain in the EU and the Eurozone. Greece is lucky to be in such a position.

The New York Times declares, “For Europe’s Sake, Keep Greece in the Eurozone,” that the European Union should “offer some path forward for the Greek economy, starting by writing down its huge and unpayable debts.” More than likely EU leaders will work out a new agreement with Greece to enable it to remain in the EU and the Eurozone. Greece is lucky to be in such a position.

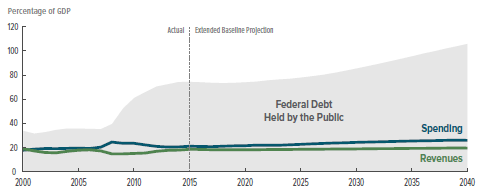

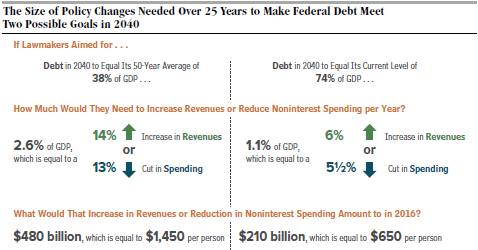

In a recent post, “Could the U.S. End up Like Greece? II. How Long Will It Take?”, I pointed out that the U.S. is likely to have a public debt of 175% of GDP by 2040, the same level as the Greek debt today. Furthermore interest rates are likely to be higher than their unusually low level today which means that we will be making proportionally higher interest payments at that time. In other words, we are likely relatively soon, within 25 years, to have a painfully high level of debt.

Who is going to bail us out when our own debt becomes “unpayable”? Obviously, no one! Right now the austerity and pain caused by the Greek debt is confined to the 11 million people in Greece.

Which is better? For us to bite the bullet now and get our fiscal house in order by, for example, moving towards annual balanced budgets Or to wait until our debt becomes unbearable and there is no one to bail us out?

We are so big that if this ever happens and drastic measures have to be taken, much of the world will be drawn into the suffering along with us. It won’t be a pretty sight!

Here is a good example of this refusal to take the debt seriously. The advocacy group FAIR (Fairness and Accuracy in Reporting) ridicules NPR for addressing this problem, “

Here is a good example of this refusal to take the debt seriously. The advocacy group FAIR (Fairness and Accuracy in Reporting) ridicules NPR for addressing this problem, “