As I gear up to enter the 2018 Nebraska Republican Primary for U.S. Senate, see here and here, I am focusing on what I consider to be the overwhelmingly most critical and urgent issue facing our country: our rapidly growing national debt, now 77% of GDP (for the public part on which we pay interest), and steadily getting much worse. Nevertheless, just over a year ago an unexpected political earthquake shook the country as Donald Trump was elected President. As I become a candidate myself for national office, I need to make clear what I think about Mr. Trump. I will start out by saying that I did not vote for him because of his sleazy behavior towards women.

I will try to be objective about his accomplishments in office, both positive and negative.

On the positive side:

- He is standing tough on North Korea, working with the U.N., China and other Asian countries to impose strong sanctions on the North Korean economy. He is upgrading U.S. missile defense, as a smart precaution against a North Korean attack on the U.S.

- He has worked with many other countries to eliminate the ISIS physical caliphate.

- He has cajoled NATO members into contributing an additional $12 billion towards our collective security.

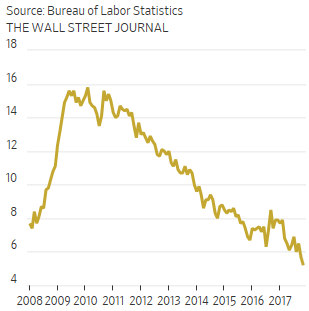

- The economy is now growing at a 3% annual rate thanks (at least in part) to his efforts at regulatory reform.

However, on the negative side:

- The new tax law, which he signed, is likely to kick off higher inflation with the trillion dollar artificial stimulus from increased debt. This will lead to much higher interest rates which will make our huge debt far more costly.

- His noxious tweets undermine his presidency, by overshadowing his achievements. His personal popularity has dropped from 46% right after the election to 35% today.

Conclusion. The best way for a member of Congress (or candidate for same) to respond to President Trump’s erratic behavior is by being objective, agreeing with him if possible and not hesitating to call him out when necessary. This is what I will try to do.