With Donald Trump expanding the culture wars and the Democrats lining up with the progressive policies of Bernie Sanders, the national political scene seems to be getting more confusing all the time.

And yet there is remarkable consensus on many levels about what the country really needs:

- Faster economic growth would help provide more jobs and better paying jobs for the blue-collar workers which both parties are trying to appeal to.

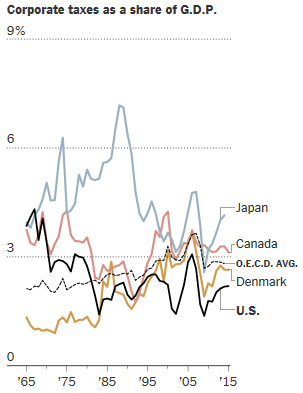

- Tax reform meaning to reduce tax rates, shrink deductions and generally simplify the tax code has widespread bipartisan support, as one way to provide the growth which everyone wants.

- Shrinking the debt as a percentage of GDP is widely recognized as critical to the future well-being of our country and especially for the poor who are most dependent on social welfare programs. How to curtail spending sufficiently to get this done is inevitably a highly contentious issue.

- Healthcare for (almost) all is now the law of the land, given that the GOP has failed to repeal the Affordable Care Act. The emphasis going forward should be to control healthcare costs for both individuals and families as well as for the federal government (the taxpayers).

- Immigration and DACA. There appears to be strong bipartisan support in Congress for giving the Dreamers legal status in the U.S. With a very low (4.4%), and still dropping, unemployment rate, a huge labor shortage is developing in many states, including Nebraska. What the U.S. needs is an expanded guest worker visa program so that all employers are able to find the (legal) employees they need to conduct business. Perhaps DACA reform will lead to broader immigration reform as well.

Conclusion. The above issues should be largely amenable to bipartisan consensus. Both parties would benefit from putting aside petty differences and working together to solve them.

Follow me on Twitter

Follow me on Facebook