A recent column by David Brooks in the New York Times, “Minimum Wage Muddle,” is a good summary of the pros and cons of raising the minimum wage for the whole country. Mr. Brooks refers to a recent Congressional Budget Office report that a hike in the minimum wage to $10.10 per hour might lift 900,000 out of poverty but would also likely mean a loss of 500,000 jobs.

As suggested in a recent post, one of the things we could do to get beyond our political dysfunction at the national level is to:

As suggested in a recent post, one of the things we could do to get beyond our political dysfunction at the national level is to:

- Put a greater emphasis on state-centered federalism both to encourage experimentation and innovation in the American system and to remove issues from the national agenda which contribute to division, stalemate and endless controversy.

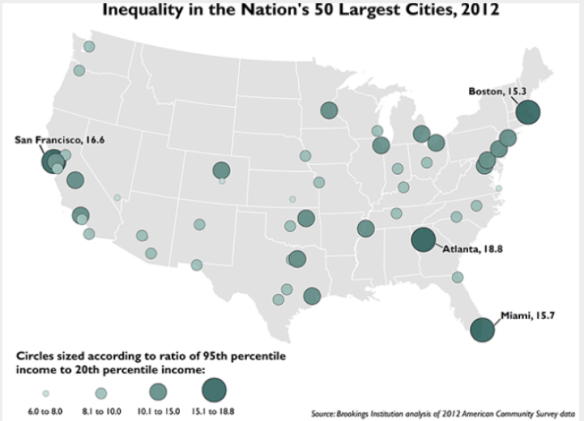

Considering that income inequality varies so greatly from one part of the country to another, (see above), it makes a lot of sense to federalize the minimum wage issue. In other words, let cities and states set their own minimum wage levels based on their own local circumstances.

Considering that income inequality varies so greatly from one part of the country to another, (see above), it makes a lot of sense to federalize the minimum wage issue. In other words, let cities and states set their own minimum wage levels based on their own local circumstances.

For example, the state of Nebraska, with very little inequality and where I live, has just raised its minimum wage to $8/hour ($9/hour beginning January 2016). Nebraska’s lowest in the country unemployment rate of 2.6% means that hardly anyone will lose their job.

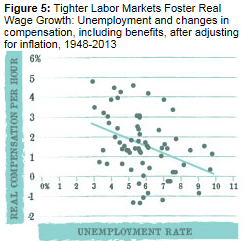

As Mr. Brooks says, “Raising the minimum wage will produce winners among job holders from all backgrounds, but it will disproportionately punish those with the lowest skills, who are least likely to be able to justify higher employment costs.”

Conclusion: raising the national minimum wage is not the best way to address the inequality and fairness issue. A better way is to create more jobs by boosting the economy overall. Then help low wage workers take home more money with a (perhaps expanded) Earned Income Tax Credit. Cities and states can establish their own individual minimum wages however they wish.