Like many other people I am upset that President Trump has decided to withdraw from the Paris Climate Accord. It’s not that Paris solves the global warming problem but it is a major step in the right direction. We’re the biggest contributor of carbon emissions so it is our responsibility to lead in reducing them.

Here are some other major issues that need leadership:

- Trade. The Trans-Pacific Partnership would have been a big win for the U.S. But it is with China, responsible for two-thirds of our trade deficit, that we need a major rebalance.

- NATO. Mr. Trump has withdrawn his campaign statement that NATO is “obsolete.” His criticism of NATO could turn out to be useful if it leads to an increase in NATO defense spending.

- Faster Economic Growth. Economic strength is the backbone of our influence in world affairs. Lower corporate tax rates will encourage our multinational companies to bring their profits back home for reinvestment in the U.S. Administration efforts already under way to deregulate various aspects of the U.S. economy should soon lead to faster growth.

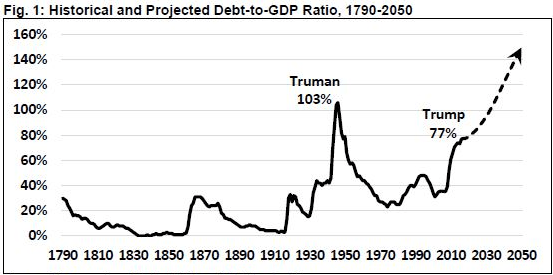

- U.S. Budget. Mr. Trump has proposed to balance the U.S. budget within ten years which is hugely important. Unfortunately many of his specific proposals on spending and growth are not realistic.

- Infrastructure Spending. This is an excellent idea if it is paid for directly and does not add to the federal deficit. Apparently Mr. Trump will soon announce a plan for private industry, cities and states to take the lead in new infrastructure spending with possible contributions from the federal government.

Conclusion. Although Paris is a disappointment, Mr. Trump will have many opportunities to redeem himself.