It is now just ten days until the new government fiscal year begins on October 1 and Congress has not yet passed a budget for the new fiscal year. Although a temporary funding bill could be brought up and passed at any time, the Washington Post thinks that there are six big impediments to adopting a new budget.

They are:

They are:

- Planned Parenthood. 31 House Republicans insist that they will support no spending bill which has funding for Planned Parenthood. Short term funding should not be in danger because the Democrats will step in if necessary to keep the government open.

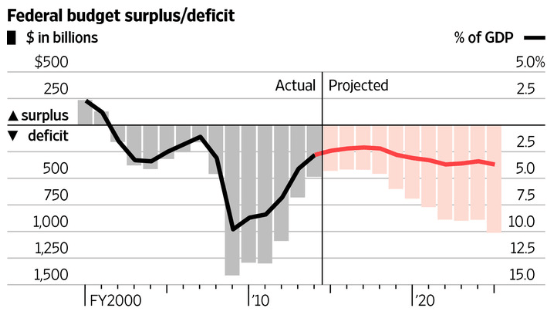

- The Sequester. This is a much tougher issue because the Democrats want to break the 10 year Sequester spending limits. It’s the Republicans strongest leverage and they should insist on dollar for dollar spending cuts elsewhere in order to relax the Sequester cuts.

- A Challenge to Boehner. The anti-Planned Parenthood caucus is threatening to try to oust John Boehner as Speaker if they don’t get their way. Hopefully the Democrats would help to keep Boehner because any replacement would be more conservative and less accommodating to them. I personally think that John Boehner is a miracle worker given the hyper-partisanship in Washington at the present time.

- The Iran Nuclear Deal. Republican desire to express opposition to the Nuclear Deal could surface as a bargaining chip in budget negotiations. As bad as the Nuclear Deal is, this is a bad budget strategy.

- The Export-Import Bank. The Ex-Im Bank expired in June. Its supporters might try to refund it as part of a budget deal for next year. It should be allowed to die unless it undergoes reform to remove subsidies for big businesses such as Boeing and GE.

- The Highway Trust Fund. The problem is that the 18 cent/gallon federal gasoline tax is insufficient to fund our infrastructure needs. The most sensible approach is to raise the gas tax by a few cents per gallon. Attempts to provide funding from other sources should be resisted.

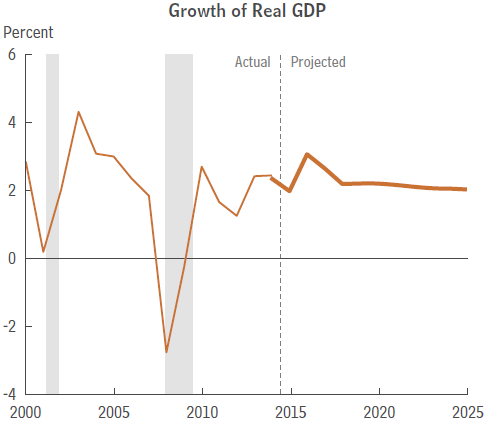

Bottom Line: Republicans should be flexible except on overall spending limits. It is absolutely essential to the future wellbeing of our country to strongly focus on eliminating budget deficits.