The Republicans in Washington are exuberant because passing the new tax law means that they finally have gotten something done. And the new law will have at least one highly beneficial effect:

- The new 21% corporate tax rate will increase profits for domestic corporations and encourage multinational corporations to bring their foreign profits back home. Even if these profits are used to buy back company stock or are paid out in larger dividends, the new money will be put to use in the U.S. economy one way or another. This will give the economy a boost and create new and better paying jobs. This is how private enterprise works and it is the best economic system ever invented.

But at the same time the new law has two huge deficiencies which make it a net minus on the whole:

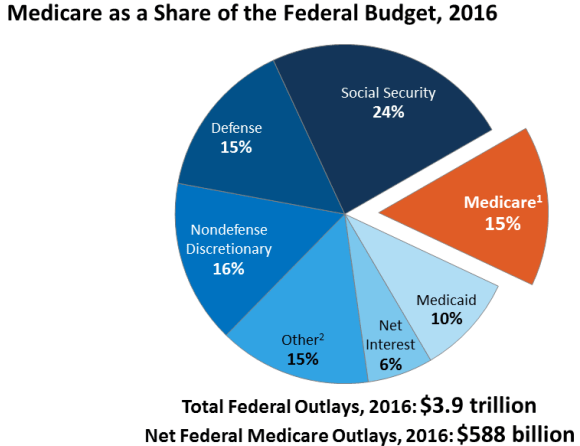

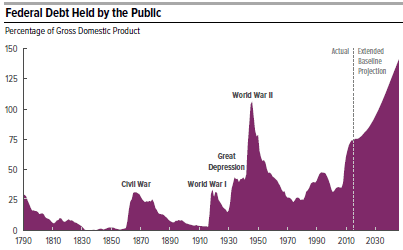

- It adds $1 trillion to our debt over the next ten years, as scored by the joint Committee for Taxation, the official scorekeeper. And this is after the positive economic effect is taken into account. Our debt is already 77% of GDP (for the public part on which we pay interest), the highest it has been since right after WWII, and will continue to get worse without major changes in public policy. As interest rates rise and return to normal historical levels, interest payments on the debt will increase quickly, creating a huge drain on the federal budget.

- The trillion dollar artificial stimulus created by the new tax law, i.e. the trillion dollars in new debt, is likely to overheat the economy, which is now already growing at a 3% annual clip. This means that inflation is likely to gain increased momentum, thereby causing the Federal Reserve to raise interest rates faster than it otherwise would. This means that interest payments on the debt will be pushed up even faster than otherwise. Without fiscal retrenchment, a new fiscal crisis is virtually inevitable in the relatively near future.

Conclusion. Fiscal restraint in Congress is now more urgently needed than ever, and it is going to be even harder to accomplish than before the new tax law was passed. I am an eternal optimist but it sure would be easy to get discouraged!