The Budget Committee of the House of Representatives has just issued a report “The War on Poverty: 50 Years Later”, providing an excellent summary of federal antipoverty programs and their cost at the present time (budget year 2012). Highlights are:

- The federal government spent $799 billion on 92 different programs to combat poverty

- Over $100 billion was spent for 15 different food aid programs

- Over $200 billion was spent on cash aid

- Over $90 billion spent on education and job training (over 20 programs)

- Nearly $300 billion spent on healthcare

- Almost $50 billion spent on housing assistance

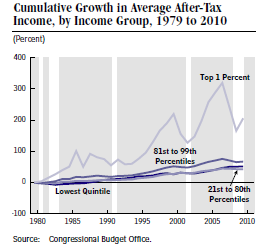

The report also points out that many low-income households face very high effective marginal tax rates, approaching 100%, if any members are employed, because making more money means losing welfare benefits. This discourages low-income individuals from working at a time when the labor-force participation rate has fallen to a 36-year low of 62.8%.

Here’s the situation: we have a rapidly growing federal budget with huge deficit spending (see above chart), a stalled economy with low labor-force participation, and an inefficient welfare system which encourages people not to work. Surely our goal should be to motivate welfare recipients to become productive citizens by returning to the workforce. So doesn’t it make sense to revamp our welfare system to be more efficient as well as to create more incentives for recipients to get and hold a job?

Here’s the situation: we have a rapidly growing federal budget with huge deficit spending (see above chart), a stalled economy with low labor-force participation, and an inefficient welfare system which encourages people not to work. Surely our goal should be to motivate welfare recipients to become productive citizens by returning to the workforce. So doesn’t it make sense to revamp our welfare system to be more efficient as well as to create more incentives for recipients to get and hold a job?

Apparently this does not make sense to the New York Times. Two days ago they ran an editorial “Mr. Ryan’s Small Ideas on Poverty”, castigating Paul Ryan for “providing polished intellectual cover for his party to mow down as many antipoverty programs as it can see.” The editorial goes on to say that “it’s easy to find flaws or waste in any government program, but the proper response is to fix those flaws, not throw entire programs away as Mr. Ryan and his Party have repeatedly proposed. . . . For all their glossy reports, Republicans have shown no interest in making these or any other social programs work better.”

Putting it as charitably as possible, the NYT is being unhelpful. It is a beacon of progressive thought for millions of Americans. But it is apparently unwilling to give any credence to a sincere effort by fiscal conservatives to reform a major government program to make it operate more efficiently and effectively.