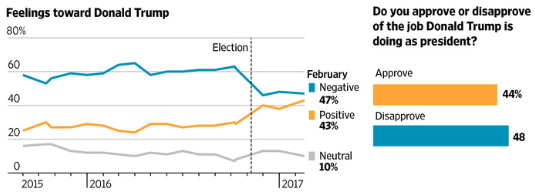

Like many things about Donald Trump, his approval ratings are contradictory and misleading. The Wall Street Journal reports that:

- Only 44% of Americans currently approve of President Trump’s job performance (while 48% disapprove) which is historically low for a new President.

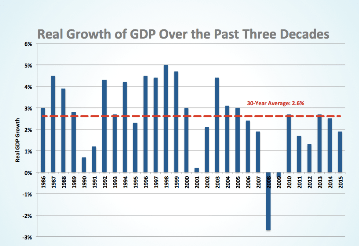

- On the other hand, the percentage of Americans who have positive feelings about him has been steadily increasing ever since he declared his candidacy in June of 2015, and has now reached a high of 43% (see chart). Since his State of the Union speech was generally well received, this rating is likely to go even higher.

Here is my own perspective. As I have said many times on this blog, I believe our country’s two biggest and most urgent problems are:

- Slow economic growth, averaging just 2% per year since the end of the Great Recession in June 2009. This means fewer jobs, smaller raises for workers and less tax revenue to spend on important national initiatives.

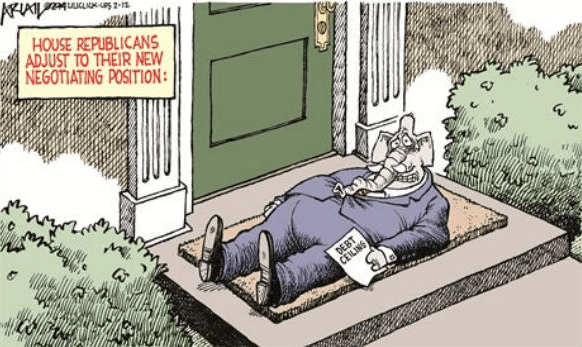

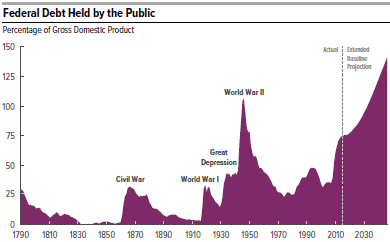

- Massive Debt, now standing at 77% of GDP (for the $14 trillion public debt on which we pay interest), the highest since right after WWII. The Congressional Budget Office predicts that this debt level will keep on steadily getting worse, without big changes in current policy. It is therefore a huge threat to our national security and prosperity.

I have great confidence that the Trump administration and Congressional allies will put a high priority on faster growth and are likely to be able to achieve it. I can’t yet tell if Trump understands the seriousness of our massive debt. But the Tea Party and Freedom Caucus members in the House of Representatives do very strongly understand this problem and will insist on addressing it. I believe that they will be able to persuade the President to support them in doing this.

Conclusion. At this point I am a supporter of President Trump because I think that our national government is moving in the right direction.