The Trump Administration has proposed a tax reform plan, with both good and bad features, and it is not yet known how Congress will respond to it. In the meantime we should focus on what tax reform can accomplish if does right:

- Lower tax rates. Most observers agree that lower tax rates will increase economic growth by encouraging more business investment. Since the end of the Great Recession in June 2009, GDP has grown at the historically slow rate of 2% per year. Any additional growth will be beneficial by tightening the job market, thereby creating more jobs as well as higher wages for the already employed.

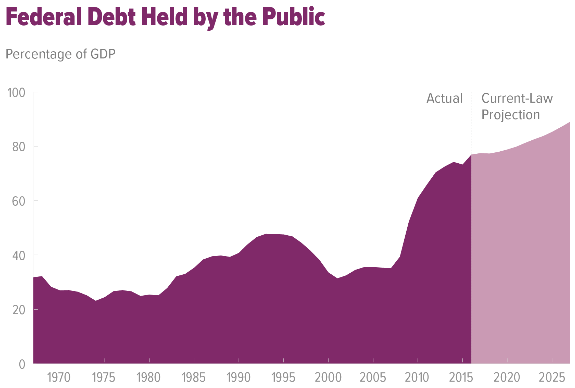

- Revenue neutrality. Our public debt (on which we pay interest) is now 77% of GDP, the highest it has been since right after WWII. At the present time interest rates are so low that the debt is almost “free” money. But interest rates will inevitably rise back to more normal levels in the future. When this does happen, whether it be sooner or later, interest payments on our ever increasing debt will skyrocket, and eat up as much as a third of federal tax revenue. A huge fiscal crisis will then occur, far worse than the Financial Crisis of 2008.

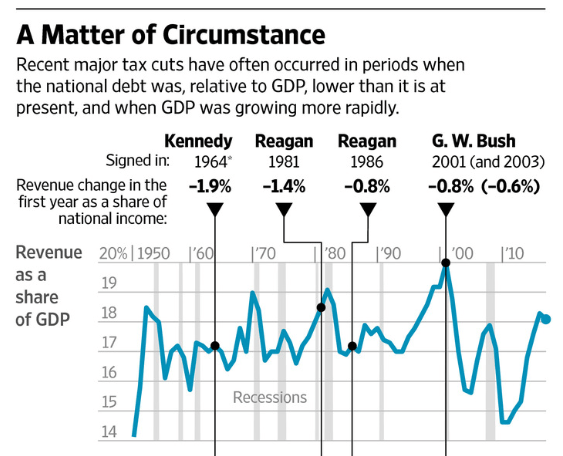

- Observing historical precedent. There have been five tax rate cuts in the last half century: (Kennedy (1964), Reagan (1981, 1986) and Bush (2001, 2003)). Note that public debt was 40% or less of GDP at the time of each of these tax cuts (see chart). The revenue losses associated with each was temporary and the first three at least strongly stimulated new growth.

Conclusion. Our national debt is much too high at the present time to adopt a tax reform plan with an extravagant disregard for revenue loss. The current debt level is so high (and projected to keep getting steadily worse) that modest tax rate cuts, coupled with significant spending restraint, is clearly called for.