The two main themes on this website, “It Does Not Add Up,” are that the U.S. national debt is too high and that our economy is growing too slowly. How can we shrink the debt (as a percentage of GDP) and how can we make the economy grow faster? I make use of all sources of information which shed light on these two fundamental issues.

Today I briefly discuss the work of the Northwestern University Economist Robert Gordon, summarized in his new book, “The Rise and Fall of American Growth.” His basic thesis, see the above chart, is that human civilization experienced essentially no economic growth up until about 1700, then slow growth occurred mainly in the UK and US up until about 1870 followed by explosive growth mainly in the US up until about 1970. Since 1970 growth has slowed way down except for a brief spurt from 1994 – 2004.

Today I briefly discuss the work of the Northwestern University Economist Robert Gordon, summarized in his new book, “The Rise and Fall of American Growth.” His basic thesis, see the above chart, is that human civilization experienced essentially no economic growth up until about 1700, then slow growth occurred mainly in the UK and US up until about 1870 followed by explosive growth mainly in the US up until about 1970. Since 1970 growth has slowed way down except for a brief spurt from 1994 – 2004.

According to Mr. Gordon, these growth periods were caused by Industrial Revolution #1 (steam, railroads), IR #2 (electricity, internal combustion, modern plumbing, communications, petroleum), and IR #3 (computers, internet, mobile phones), all of which led to productivity growth spurts which have by now largely run their course. Not only are we out of industrial revolutions but there are, in addition, stiff headwinds working against economic growth. For example:

- The First Headwind: Rising Inequality. Downward pressure on the wages of the bottom 90%. Increased inequality at the top. Educational outcomes strongly correlated with socio-economic status.

- The Second Headwind: Education. Stagnation in high school graduation rates and poor performance on international tests measuring achievement. High debt levels for college graduates.

- The Third Headwind: Demography. The labor participation rate has dropped form 66.0% in 2007 to 62.6% today, only half caused by baby boomer retirements.

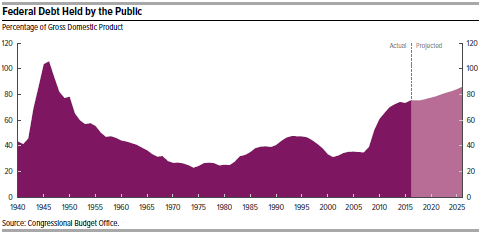

- The Fourth Headwind: Repaying debt. The public debt, on which interest is paid, is now 74% of GDP and is predicted by the CBO to steadily increase. This will inevitably lead to either higher taxes or slower growth in future transfer payments.

- The Fifth Headwind: Social deterioration at the bottom of the income distribution. Increasing number of children are born out of wedlock for high school graduates and dropouts, much higher for blacks than for whites. For mothers aged 40, the percentage of children living with both biological parents declined from 94% in 1960 to 34% in 2010.

- Other Headwinds. Globalization and Global warming.

Mr. Gordon makes a voluminous case for the slowing down of economic growth, the basic reasons why this is happening, and the social forces which are making it worse. Next: How should public policy respond to this huge challenge?

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3

A new report from the

A new report from the