In my most recent posts I have been making the case that

- The American economy is in basically good shape with a low unemployment rate of 4.2% and the likelihood of somewhat faster growth in the near future.

- Income inequality and poverty are real problems, see here and here, but there are reasonable and effective ways to address them.

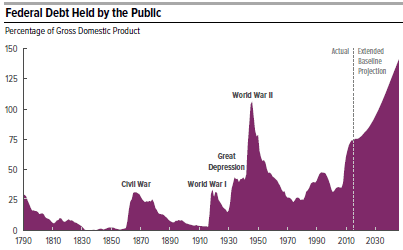

- Rapidly accumulating debt is by far our most critical unsolved problem which is all the more frightening because our polarized political system does not seem capable of addressing it.

The Bureau of Labor Statistics has just released its projections of what the U.S. economy will look like in 2026.

- More dominated by the service sector amid the continuing erosion of manufacturing jobs (see two charts below).

- More polarized in both earnings and geography (see top and bottom charts).

- More tilted towards jobs which require at least a bachelor’s degree (see bottom chart).

The BLS report has several ramifications for public policy as follows:

- Improved educational outcomes are needed all along the line: K-12 basic and vocational, training programs for the many skilled jobs going begging and also more low-cost college programs.

- More low-skill immigrants, not fewer, are needed to take on the expanding number of low-wage jobs, such as caring for the growing numbers of elderly, which Americans are not willing to do.

Conclusion. These economic trends towards more earnings and geographical polarization could easily make our current political polarization even worse than it already is. This means it is all the more important to make sure that we keep speeding up economic growth, better address income inequality and poverty and get our gargantuan debt problem under control.

Follow me on Twitter

Follow me on Facebook