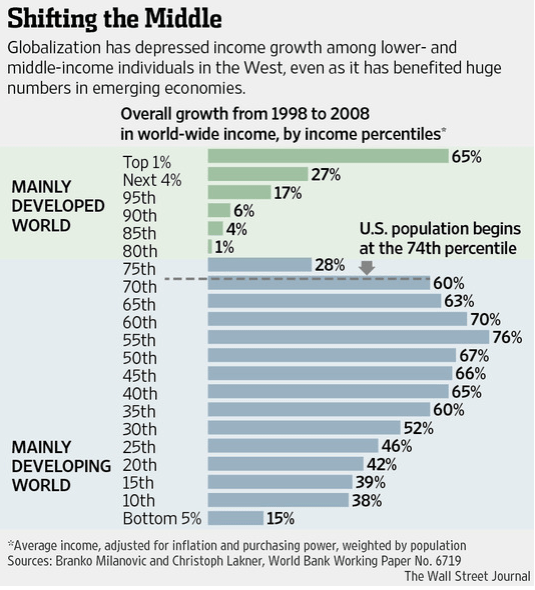

There is a stark contrast between the fiscal and economic policies being proposed by the presidential candidates from the two different parties. The Democrats want to tax the rich to reduce income inequality while the Republicans want major tax reform in order to speed up economic growth.

I favor the latter approach as long as it does not increase deficit spending. The Keynesian economist Paul Krugman mocks deficit hawks like me as “Very Serious People.” But in my “serious” view we have a choice between two very different paths for our economic future:

I favor the latter approach as long as it does not increase deficit spending. The Keynesian economist Paul Krugman mocks deficit hawks like me as “Very Serious People.” But in my “serious” view we have a choice between two very different paths for our economic future:

- Slow Growth. Continue on our present path of slow 2% annual growth. The official unemployment rate has dropped to 5% but slack in the economy caused by the low labor participation rate keeps raises low and millions still unemployed or under-employed. The slow economy also keeps inflation and interest rates low. This permits Congress and the President to shrug off deficit spending and debt accumulation because it’s virtually “free money,” being borrowed at very low interest rates. Our present course not only prolongs income inequality but also allows the debt to keep ramping up indefinitely. The longer this continues, the greater will be the disruption when inflation and interest rates do eventually return to normal historical levels.

- Faster Economic Growth. There are many things we can do to speed up economic growth. Tax reform is first and foremost but deregulation (relax Obamacare and Dodd-Frank), trade expansion (pass TPP) and immigration reform (with an adequate guest worker program) would also help. But, contrary to what the Republican presidential candidates say, tax reform must be revenue neutral to be sustainable. That way the economic growth it produces will lower deficit spending rather than increasing it. This is critical because economic growth will create new jobs and raise pay for existing jobs, thereby creating inflationary pressure. Inflation will lead to higher interest rates which in turn will make our debt much more expensive than it is now.

Conclusion. We can make our economy grow faster if we simply put our mind to it. But then inflation and interest rates will go up and interest payments on the debt will become an increasing burden on society. This is why it is so important to put our debt on a downward path as a percentage of GDP. We can make it happen if we want to.