In January I had several posts advocating in favor of a Balanced Budget Amendment to the U.S. Constitution. Briefly, the argument runs as follows:

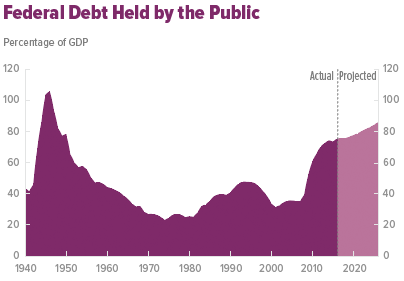

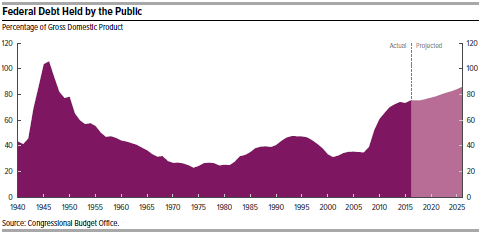

- Our public debt (on which we pay interest) is now at 74% of GDP, the highest it has been since the end of WWII.

- Democrats want to raise taxes and increase spending; Republicans want to cut taxes and decrease spending. The only way to satisfy both parties simultaneously is to run huge annual deficits which is exactly what has happened ever since the end of the Great Recession in 2009.

Current planning for the next budget year beginning October 1, 2016 has now begun. Both the House Budget Committee and the President have budget proposals for next year. As reported by the Peterson Foundation, these two budgets differ substantially:

- The President’s budget would hold the public debt at about 75% of GDP over the next ten years by both raising taxes and increasing spending on a variety of programs.

- The House Budget Committee plan keeps revenues steady at 18.2% of GDP over the next ten years and achieves a balanced budget after ten years. By 2026 the debt held by the public would fall to 57% of GDP from its current 74% level.

Here are two significantly different ten year budget plans. What is likely to happen is a complete standoff without any bipartisan agreement. This means that no appropriations bills for individual government agencies will be enacted by October 1. Finally, as usual, an omnibus spending bill will be put together by Congressional leaders and forced through at the last minute to avoid a government shutdown.

A BBA would make both sides compromise and come up with an overall plan. It would likely contain both spending restraint and new sources of revenue. Then the various Congressional committees would hammer out the spending details for individual agencies and department. It would be a far more sensible and transparent process than the way things are done now.

Congress and the President have to be forced to act in such a reasonable manner. A Balance Budget Amendment is perhaps the only way to make this happen.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3

A new report from the

A new report from the