To some readers, I am sure, I must sound like a one-note Johnny. I have a fixation on our national debt because it is so massive and so many apparently well-informed people are so complacent about it. Sometimes I feel like I’m beating my brains out by discussing this issue so often. But I don’t know what else to do.

I recently came across an article from a year ago in Time Magazine by James Grant, the editor of Grant’s Interest Rate Observer. Elaborating on Mr. Grant:

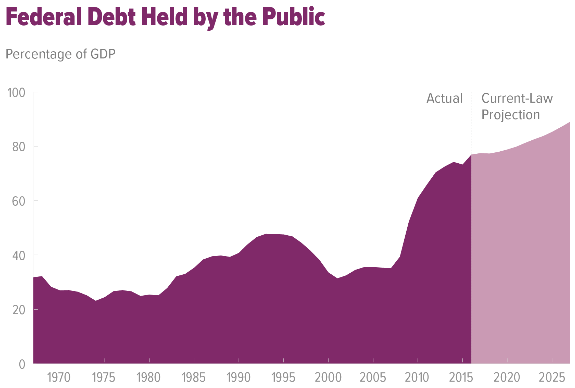

- As recently as 2007 our public debt (on which we pay interest) was $5 trillion and, with an average interest rate of 4.8%, net interest expense was $237 billion. In 2016 we owed $14.1 trillion and paid an average interest rate of 1.8% for an interest payment of $240 billion. In other words, although our public debt has almost tripled in ten years, the interest rate is just over 1/3 of what it was in 2007. So our interest payment hasn’t changed.

- Interest rates are now starting to head back up. If they return to the 2007 level of 4.8%, then today’s public debt ($14.9 trillion in 2017) would require an interest payment of $715 billion. At the rate of 6.7%, prevailing in the 1990s, today’s debt would require an interest payment of $998 billion. That represents almost 1/3 of today’s total federal revenue.

Here’s a related perspective from Jon Hall who writes for the American Thinker:

- Most of our debt is financed with 10 year Treasury Notes. “Of the marketable securities currently held by the public as of 9/30/15, $7.4 trillion or 58% will mature within the next four years.” (see GAO chart) In other words, the huge increase in debt over the past 10 years will soon have to be paid for by Treasury. This will almost surely cause more inflation which will lead to a further increase in interest rates.

Conclusion. Unwinding our current debt will require painful cutbacks over a period of years. But right now we are making the problem even worse with continued deficit spending. How will our increasingly perilous situation ever be reversed?