Several large U.S. companies have recently announced that they are planning to merge with foreign companies and move their corporate headquarters to a low tax country such as Ireland or Great Britain. The Obama Administration proposes to disallow such “tax inversions” by requiring that after such a merger at least 50% of the stock of the new company would have to be foreign owned. Otherwise the firm would still be considered American for tax purposes. Such a technical fix is unlikely to solve a much more fundamental problem.

As the latest issue of the Economist, “How to stop the inversion perversion,” makes clear, “America’s corporate tax has two horrible flaws. The first is the tax rate, which at 35% is the highest among the 34 mostly rich-country members of the OECD. … The second flaw is that America levies tax on a company’s income no matter where in the world it is earned. In contrast, every other large rich country taxes only income earned within its borders (a so-called ‘territorial system’). Here, too, America’s system is absurdly ineffective at collecting money. Firms do not have to pay tax on foreign profits until they bring them back home. Not surprisingly, many do not: American multinationals have some $2 trillion sitting on their foreign units’ balance sheets.”

A relatively simple solution to this glaring problem would be to lower the corporate tax rate to 25%, the OECD average, and shift to a territorial system. Revenue losses would be offset by closing loopholes and deductions.

A relatively simple solution to this glaring problem would be to lower the corporate tax rate to 25%, the OECD average, and shift to a territorial system. Revenue losses would be offset by closing loopholes and deductions.

A better, but likely more controversial, solution would be to completely eliminate the corporate income tax and then tax dividends and capital gains at the same rate as earned income. This would avoid the double taxation problem whereby profits are taxed first at the corporate level and then again for individuals as dividends and capital gains.

The overall goal in this entire endeavor should be to boost the economy, thereby creating more jobs, and additionally to raise the tax revenue needed to pay our bills. Fairness is important but growth is even more important!

Tag Archives: jack heidel

How to Improve America’s Welfare System

Several months ago I had a post entitled “A Balanced and Sensible Antipoverty program,” describing four characteristics of effective antipoverty programs: work requirements, work incentives, supporting married, two-parent families, and supporting business growth.

The Budget Committee of the House of Representatives has just released the outline of a new plan, “Expanding Opportunity in America,” designed to implement the above basic principles of welfare reform. The introduction states that “Fifteen percent of Americans live in poverty today – over 46 million people. … A key tenet of the American Dream is that where you start off shouldn’t determine where you end up. … Of all Americans raised in the bottom fifth of the income scale, 34% stay there and just 38% make it to the middle class or above (see the chart below).”

The idea is to let selected states experiment in consolidating separate means-tested programs such as SNAP, TANF, child-care and housing assistance programs, into a new holistic Opportunity Grant program. The purpose is to make these programs more effective in lifting welfare recipients out of poverty. Here is how the program is envisioned to work:

The idea is to let selected states experiment in consolidating separate means-tested programs such as SNAP, TANF, child-care and housing assistance programs, into a new holistic Opportunity Grant program. The purpose is to make these programs more effective in lifting welfare recipients out of poverty. Here is how the program is envisioned to work:

- Each participating state will approve a list of certified providers who are held accountable for achieving results such as moving people to work, out of poverty and off of assistance.

- Needy individuals will select a provider who will conduct a comprehensive assessment of that person’s needs, abilities and circumstances.

- The provider and the recipient will develop a customized plan and contract both for immediate financial needs and also for long term goals towards self-sufficiency.

- Successful completion of a contract will include able-bodied individuals obtaining a job and earning enough to live above the poverty line.

The U.S. is currently spending over a trillion dollars a year on welfare programs for low income families and individuals. A good way to increase both the efficiency and effectiveness of federal programs is to shift them over to state control. The Opportunity Grant program proposes to do this on an experimental basis. It makes good sense to try it!

How Likely Is Financial Collapse?

The financial crisis of 2008 was the biggest shock to our financial system since the Great Depression of the 1930s. It caused a deep recession from which we are still recovering. To aid the recovery the Federal Reserve launched an unprecedented expansion of the money supply, referred to as quantitative easing, as well as keeping short term interest rates near zero. As explained by James Rickards, a portfolio manager at West Shore Group, in his new book, “The Death of Money, the coming collapse of the international monetary system,” such a severe recession would normally have caused a corrective period of deflation. Quantitative easing has warded off deflation and, so far, without igniting inflation.

We are now in a catch-22 situation. Congress could and should adopt several policy changes to speed up the recovery as I described several days ago in “The Federal Reserve Cannot Revive the Economy by Itself.” But, if and when the economy does start growing faster, it will require great skill by the Fed to exit from its current policies without harm. If it contracts the money supply too quickly, it risks a sharp rise in interest rates. If it contracts the money supply too slowly, it risks a sharp rise in inflation. Mr. Rickards doubts that the Fed will be able to accomplish this fine tuning without another major crisis. Here are his Seven Signs of what to look for:

We are now in a catch-22 situation. Congress could and should adopt several policy changes to speed up the recovery as I described several days ago in “The Federal Reserve Cannot Revive the Economy by Itself.” But, if and when the economy does start growing faster, it will require great skill by the Fed to exit from its current policies without harm. If it contracts the money supply too quickly, it risks a sharp rise in interest rates. If it contracts the money supply too slowly, it risks a sharp rise in inflation. Mr. Rickards doubts that the Fed will be able to accomplish this fine tuning without another major crisis. Here are his Seven Signs of what to look for:

- The price of gold ($1300 per ounce today). A rapid rise to $2500 will anticipate inflation. A rapid decrease to $800 signals severe deflation.

- Gold’s continued acquisition by Central Banks. Large purchases by China, for example, will announce inflation.

- IMF governance reforms, e.g. towards more voting power for China, will be an inflation warning.

- The failure of regulatory reform, i.e. reinstatement of Glass-Steagall in addition to the Volcker Rule, will increase the chances of systemic failure.

- System crashes, resulting from high-speed, highly automated, high volume trading. An increasing tempo of such events will cause disequilibrium which could close markets.

- The end of QE, could give deflation a second wind and lead to a new round of QE.

- A Chinese collapse (predicted by Rickards), will lead first to deflation and then inflation.

We all hope that the Federal Reserve can steer clear of a new, and much deeper, financial crisis. But it doesn’t hurt to have guideposts and Mr. Rickards knows what he’s talking about.

Bush Was a Disaster; Obama Is Merely Ineffective

As Barack Obama nears the three-quarter’s mark of his presidency, it is natural that he and George W. Bush will be compared to one another. I consider them both to be disappointing presidents but in very different ways.

First, the sins of George Bush:

First, the sins of George Bush:

- The Bush Tax Cuts of 2001-2003 lowered tax rates without being offset by closing loopholes and/or shrinking tax deductions. This made his huge budget deficits much worse than they otherwise would have been and without helping the economy.

- The Iraq War. Regardless of whether or not the U.S. was justified in invading in 2003, the current ISIS uprising of Sunnis is likely to result in a worse outcome than existed before the U.S. invasion. This will come to mean that Iraq was a mistake.

- Medicare Part D (2003). The Prescription Drug program now costs the federal government about $100 billion per year. It makes the unsustainable cost of Medicare that much worse.

- The Financial Crisis of 2008. This represents an even bigger stain on his record. He appointed all of the key players such as Ben Bernanke, Tim Geithner and Henry Paulson who failed to see it coming. He also appointed Sheila Bair as head of the FDIC in 2006. She did see it coming but it was too late and she didn’t have enough clout.

Mr. Obama is very bright and articulate. But he has made many serious mistakes including:

- His total immediate attention in 2009 should have been on reviving the economy. Instead he and the filibuster-proof Democratic Congress pushed through the Patient Protection and Affordable Care Act. The employer mandate of Obamacare, even though postponed by the administration, has slowed down the economic recovery by making it more expensive for businesses to hire full time employees.

- For all of his nonpartisan campaign rhetoric about “change we can believe in,” he has been one of the most divisive and partisan presidents in many years. This has created huge animosity and distrust amongst his political opponents which makes it difficult for the two sides to negotiate differences in good faith.

- The most glaring example of this is the anemic 2.2% annual growth of the economy since the Great Recession ended in June 2009. Many economists agree that cutting both individual and corporate tax rates, offset by closing loopholes and deductions, would be hugely beneficial in boosting the economy. It would put millions of people back to work and shrink our huge deficits. Why isn’t the President talking about this and leading the charge? But, of course, this was the Romney tax plan in 2012. What’s wrong with the election winner adopting the best parts of the program of the election loser? Now that would be demonstrating real leadership ability!

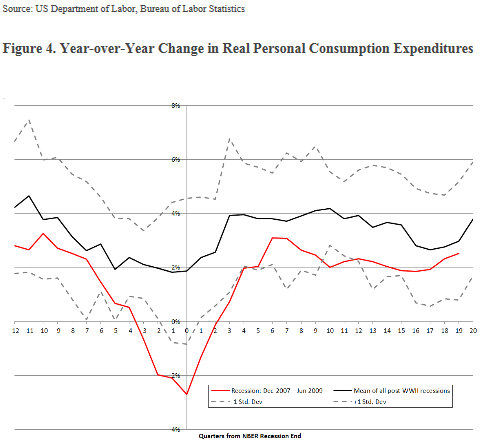

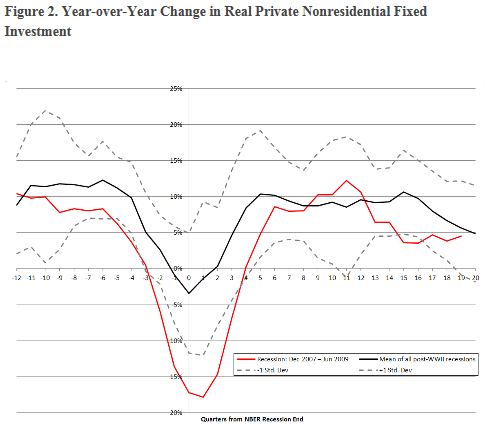

The Federal Reserve Cannot Revive the Economy by Itself

The Great Recession caused by the financial crisis ended in June 2009. In the intervening five years the U.S. economy has grown at the anemic annual rate of 2.2%. In an attempt to speed up growth the Fed has injected $4 trillion into the economy and kept short term interest rates near zero during this time period. Fed Chair Janet Yellen recently gave her semiannual report to Congress and, according to the American Enterprise Institute’s John Makin, “Fed Chair Yellen puts on a brave face.” She said that “If economy performance is disappointing, then the future path of interest rates likely would be more accommodative than currently anticipated.”

Mr. Makin adds that “Eventually the realization will dawn that the only way to get the economy moving again is to work on the supply side. Specifically, that means undertaking measures to boost investment and produce a rising capital stock which will boost labor productivity, hiring, and GDP growth without inflation.” He suggests that three measures to boost capital spending are:

Mr. Makin adds that “Eventually the realization will dawn that the only way to get the economy moving again is to work on the supply side. Specifically, that means undertaking measures to boost investment and produce a rising capital stock which will boost labor productivity, hiring, and GDP growth without inflation.” He suggests that three measures to boost capital spending are:

- Enactment of accelerated depreciation provisions and investment tax credits.

- A sharp reduction in the corporate tax rate from 35 to 15 percent to induce corporations to repatriate the $1.59 trillion in accumulated profits being held abroad.

- A concerted White House-led effort to set a clear, less burdensome path for healthcare and other regulatory measures as a means to reduce investment dampening uncertainty.

I would add a fourth measure:

- An across the board lowering of individual tax rates (offset by closing loopholes and deductions which primarily benefit the wealthy) in order to boost personal consumption which has been highly depressed due to stagnant wage growth and high unemployment.

In other words there are clear and straightforward measures which our national leaders can take to speed up the economy. ‘If there is a will, there’s a way’ and incumbents should be held responsible for inaction come the elections in November!

The Truth behind the Latest Job Figures

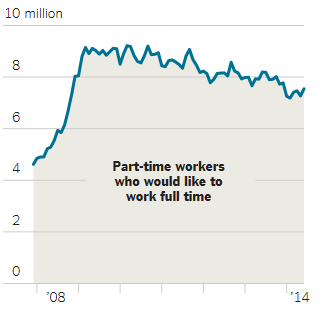

Mortimer Zuckerman, writing a few days ago in the Wall Street Journal, “The Full-Time Scandal of Part-Time America,” points out that the latest employment figure of 288,000 net jobs created in June is highly misleading. “Full-time jobs last month plunged by 523,000, according to the Bureau of Labor Statistics. What has increased are part-time jobs. They soared by about 800,000 to more than 28 million.” Mr. Zuckerman goes on to say, “Since 2007 the U.S. population has grown by 17.2 million, according to the Census Bureau, but we have 374,000 fewer jobs since a November 2007 peak and are 10 million jobs shy of where we should be.”

Interestingly, the New York Times discusses the same problem from a different point of view, ”A Push to Give Steadier Shifts To Part-Timers”. The NYT does recognize that there are now about 7.5 million part-time workers who would prefer full time employment but are unable to find it. But the emphasis is on giving them more advance notice for changes in work schedules.

Interestingly, the New York Times discusses the same problem from a different point of view, ”A Push to Give Steadier Shifts To Part-Timers”. The NYT does recognize that there are now about 7.5 million part-time workers who would prefer full time employment but are unable to find it. But the emphasis is on giving them more advance notice for changes in work schedules.

The only way that we’ll get what we really need, more jobs, more good jobs and more fulltime jobs, is by faster economic growth beyond the anemic 2.2 average growth rate since the recession ended five years ago. Here are several ways to accomplish this:

- The most obvious and immediate thing we should do is to lower the corporate tax rate from its currently highest in the world level of 35%. This will stop the hemorrhaging of U.S. companies moving overseas and encourage multinational corporations to bring their profits home and reinvest them in the U.S.

- Broad-based individual tax reform, with lower tax rates for all, offset by closing loopholes and shrinking deductions which primarily benefit the wealthy. This will put more money in the hands of the two thirds of Americans who do not itemize their tax deductions. Since these are the middle and lower income wage earners with stagnant incomes, they will spend their extra income thereby giving the economy a big boost.

- The employer mandate in Obamacare is responsible for some of the shift from fulltime to part-time employment, and should be repealed (it has already been suspended for two years by the Obama Administration).

These are just common sense reforms which should be doable by Congress without a huge ideological fight. We badly need leadership capable enough to do this!

How to Control Federal Spending III. Reform Medicaid!

One of the many controversies involving the Affordable Care Act concerns the expansion of Medicaid to cover low income people up to 138% of the federal poverty level. As Robert Samuelson reported in the Washington Post a few days ago, “The Real Medicaid Problem,” 24 states have refused to expand Medicaid coverage even though the federal government will pay 100% of all additional costs until 2017.

As Mr. Samuelson points out, the underlying issue is a matter of cost:

As Mr. Samuelson points out, the underlying issue is a matter of cost:

- The basic Medicaid program is funded with a fixed percentage of each state’s costs paid by the federal government. This means that the more a state spends, the more is contributed by the federal government. From 1989 to 2013, the share of state budgets devoted to Medicaid has risen from 9% to 19%. This upward trend is clearly unsustainable.

- In Medicaid, children and adults up to age 65 represent three-fourths of beneficiaries, but only one-third of costs. The quarter of beneficiaries who are aged or disabled are responsible for two-thirds of costs.

- More than 60% of nursing home residents are on Medicaid.

- There is no assurance that the federal share of the expanded coverage will continue at the announced rate of 90% after 2017 because the federal government is in much worse financial shape than are most states.

An interesting Op Ed appeared recently in the Wall Street Journal, “The Smarter Way to Provide Health Care for the Poor,” written by Mike Pence, the Governor of Indiana. In 2008 Indiana set up the Healthy Indiana Plan to better serve low income Indianans. It now provides Health-Savings Accounts to 40,000 low income citizens, with very good results. Indiana is applying for a waiver to the ACA to use Medicaid expansion funds to provide HIP to all low income families up to 138% of the poverty level ($33,000 for a family of four).

Clearly, individual states, when offered the opportunity, are quite capable of coming up with innovative solutions for difficult problems.

A good way to resolve the problem of state resistance to Medicaid expansion is to fundamentally change Medicaid into a block grant program whereby the federal government contributes a specific amount of money to each state each year. Then the states design their own programs to meet their own needs. Block grant funding for Medicaid is a common sense approach to address one aspect of our huge fiscal problem in an intelligent way!

Now Is the Time to Solve Our Illegal Immigration Problem!

The sight of thousands of children from Central America sitting in camps at the U.S. border should knock some sense into those members of Congress who are dragging their feet on comprehensive immigration reform. Overall, illegal border crossings are at their lowest level in many years (see chart below). Now is the time to get things straightened out before the illegal traffic starts building up again.

When the New York Times, “The Border Crisis,” and the Wall Street Journal, “A Better Border Solution,” agree on an issue, I tend to agree with them. Both newspapers say that the current crisis is the result of illegal immigrants in the U.S. trying to rescue their children from deplorable conditions back home. If they had legal status they would go home themselves and bring their children back to the U.S. but they can’t risk doing this without a visa.

When the New York Times, “The Border Crisis,” and the Wall Street Journal, “A Better Border Solution,” agree on an issue, I tend to agree with them. Both newspapers say that the current crisis is the result of illegal immigrants in the U.S. trying to rescue their children from deplorable conditions back home. If they had legal status they would go home themselves and bring their children back to the U.S. but they can’t risk doing this without a visa.

As I pointed out in a recent blog, “Immigration Reform Will Benefit Nebraska,” it shouldn’t be that hard to achieve a comprehensive solution as follows:

- All businesses would compile a list of their current employees who are illegal. Everyone on this list, without a criminal record, would receive a guest worker visa as of a certain date. Visas would be transferable from one employer to another.

- Companies would be authorized to hire additional foreign workers in their home countries who would then receive a guest worker visa to enter the U.S.

- Once the system was set up and operational, all businesses would be required to periodically demonstrate the legal status of all workers.

- Guest workers would be eligible to apply for citizenship after a relatively lengthy period of time.

America needs immigrant labor to do the hard low skilled physical work such as in agriculture, meatpacking, and construction, which most Americans don’t want to do. An adequate guest worker system would virtually eliminate illegal immigration, thereby solving a huge current law enforcement problem. It would also give the U.S. economy a big boost by providing all businesses with an adequate source of labor.

We have got to get beyond our hang-up about amnesty to solve this incredibly serious problem!

How to Control Federal Spending II. A General Approach

“Life’s tragedy is that we get old too soon and wise too late”

Benjamin Franklin, 1706 – 1790

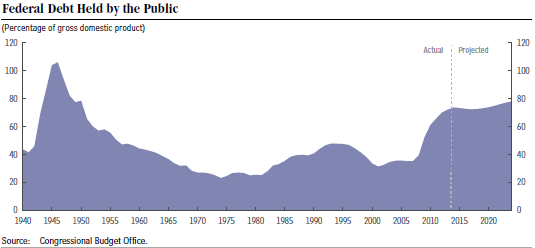

The above chart from the Congressional Budget Office’s latest budget forecast “Updated Budget Projections: 2014 to 2024” shows very clearly how the public debt (on which we pay interest) has climbed dramatically in the last six years, as a percentage of GDP, and is projected to keep on growing indefinitely. As the economy improves and interest rates return to normal levels, interest payments on the debt will skyrocket and become a permanent drag on future growth.

The above chart from the Congressional Budget Office’s latest budget forecast “Updated Budget Projections: 2014 to 2024” shows very clearly how the public debt (on which we pay interest) has climbed dramatically in the last six years, as a percentage of GDP, and is projected to keep on growing indefinitely. As the economy improves and interest rates return to normal levels, interest payments on the debt will skyrocket and become a permanent drag on future growth.

In a recent post “How to Control Federal Spending: The Highway Trust Fund” I pointed out that thanks to the Budget Sequester Act from 2011, it is unlikely that the $35 billion Highway Trust Fund, supported by an 18.2 cent per gallon federal gasoline tax, will be supplemented by general government revenue, paid for by increasing the deficit. In other words, discretionary spending is under control at the present time due to the ten year sequester limits.

But this makes up less than 1/3 of the federal budget, the rest being “mandatory” entitlement spending, for such programs as Social Security, Medicare and Medicaid. This is where the huge projected future growth in overall federal spending comes from and therefore where we need to focus on budget control. The huge challenge is that the number of Americans who are retired, now about 50 million, is growing rapidly. Furthermore, older citizens vote in greater proportion than any other age group and don’t want their benefits to be cut. Elected representatives need help to resist the pressure from senior citizens for greater benefits. Here are two possible ways to provide this help:

- A Balanced Budget Amendment to the U.S. Constitution. It would have to be flexible enough to allow overrides for emergencies by a supermajority vote, but otherwise it would force Congress to either cut spending or else raise taxes to bring in more revenue. The tradeoff between these two alternatives would create the discipline to make the hard choices required.

- Term Limits for national office. I would choose 12 year limits for both the Senate and the House of Representatives but other choices are possible. Knowing that one’s time in office is limited will help provide the strength to make the difficult decisions to either cut spending or raise tax revenue. New members of Congress are more independent thinking than the careerists whose main goal is to get reelected.

Either of these two possible changes in the rules would help turn things around. We need to do something before we have another financial crisis much worse than the last one!

Freedom and Equality

The Wall Street Journal published its first issue on July 8, 1889 and today it is appropriately celebrating its 125th anniversary. The lead editorial refers to its consistent editorial policy over the years as well as admitting several mistakes along the way. “These columns emphasize liberty, but on occasion those who prize equality can provide a necessary corrective. The best example is the civil rights movement … Yet those who promote freedom typically do better by equality than the progressives who elevate equality do by freedom.”

Today’s WSJ Op Ed page is devoted to “Ideas for Renewing American Prosperity” provided by many different luminaries (who were asked to propose one change in American policy, society or culture to revive prosperity and self-confidence), such as:

Today’s WSJ Op Ed page is devoted to “Ideas for Renewing American Prosperity” provided by many different luminaries (who were asked to propose one change in American policy, society or culture to revive prosperity and self-confidence), such as:

- George Shultz, Return to Constitutional Government, meaning that “the president governs through people who are confirmed by the Senate and can be called upon to testify by the House or the Senate at any time. They are accountable people,” as opposed to unaccountable White House aids.

- Heather MacDonald, Encourage Two-Parent Families. “Children raised by single mothers fail in school and commit crime at much higher rates than children raised by both parents. Single-parent households are far more likely to be poor and dependent on government assistance. But far more consequential is the cultural pathology of regarding fathers as an optional appendage for child rearing.”

- George Gilder, Listen to Peter Drucker on Regulations. “At least half the bureaus and agencies in government regulate what no longer needs regulation.” We need “a new principle of effective administration under which every act, every agency, and every program of government is conceived as temporary and as expiring automatically after a fixed number of years.”

- Sheila Bair, Find a Better Way to Tax the Rich. “By eliminating corporate income taxes, we would ease pressure on U.S. wages, bring back jobs and repatriate an estimated $2 trillion in profits stashed elsewhere. … It would be smarter to tax corporate profits once, at the shareholder level, and apply the same, higher rates to capital gains and dividends that apply to us working stiffs.”

These sentiments are really just non-ideological common sense. They might seem to be overly idealistic but are, nevertheless, quite doable if enough of our national leaders would just make them a priority. This is why we so badly need independent-minded non-partisans in national office!