Both President Trump and the Republican Congress want the economy to grow faster than the slow 2% growth which we have experienced since the Great Recession ended in June 2009. The Congressional Budget Office predicts (see chart below) that growth will average just 1.8% over the next ten years under current policy.

The Committee for a Responsible Federal Budget, using CBO data, believes that several policy changes can help boost growth on an annual basis as follows:

- Immigration reform, .3%, by increasing the number of workers.

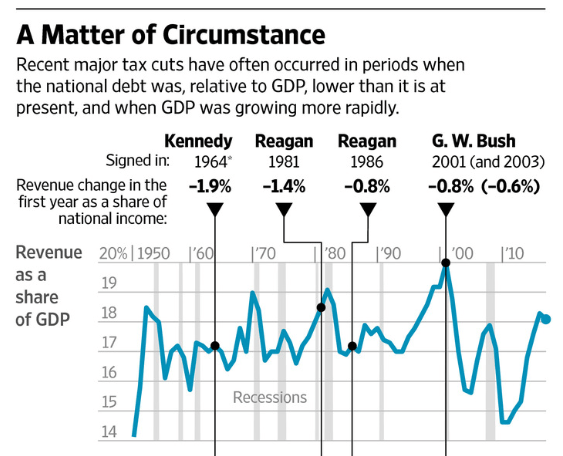

- Tax reform, .18%, if well designed. However, deficit-financed tax reform would ultimately harm growth.

- Increase the Social Security retirement age by two years, .15%, by keeping people in the workforce longer.

- Reduce deficits by $4 trillion over ten years, .1%. This is enough deficit reduction to put our debt on a sustainable, downward path.

- Continue expanding energy production at the shale boom level, .09%.

- Repeal of the Affordable Care Act, .08%, will keep more people in the workforce.

- Ratifying the Trans Pacific Partnership, .01%, by increasing foreign trade.

- Increasing public investment in infrastructure, education and research by $40 billion per year, .1%.

Note that all of these changes would increase growth by an estimated .83% of GDP per year. Added to the 1.8% base this yields a growth rate of 2.63%. Unfortunately, many of these reforms are unlikely to occur. On the other hand, various deregulatory actions being taken by the Trump administration are likely to increase growth by an unknown amount.

Conclusion. It is reasonable to anticipate that growth can and will be speeded up to about 2.5% of GDP per year under the Trump administration. Along with the tight labor market now developing (current unemployment rate of 4.4%), blue-collar and other middle class workers should continue to receive decent pay increases for the foreseeable future.