In my last post, “What the Republican presidential candidates should be saying,” I summarized the argument by the economist, John Cochrane, that “sclerotic growth is the economic issue of our time.” Mr Cochrane shows dramatically that even small differences in the growth rate over time can make a huge difference in raising living standards.

He goes on to say that

He goes on to say that

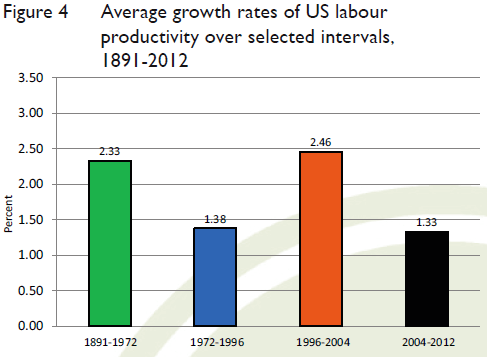

- There is only one source of growth. Nothing other than productivity matters in the long run.

- The vast expansion in regulation is the most obvious change in public policy accompanying America’s growth slowdown. Most recently under the Dodd-Frank Act and the Affordable Care Act, the financial and healthcare sectors of the economy have seen radical increases in regulatory intervention. But environmental, labor, product and energy regulation have all increased dramatically as well.

- Regulation during the financial crisis did not fail for being absent. It failed for being ineffective.

- The best way for the government to subsidize healthcare efficiently is to give straightforward vouchers which people can use to buy insurance or to fund health savings accounts. Such vouchers should replace Obamacare, Medicaid and Medicare.

- The basic structure of growth-oriented tax reform is lower marginal rates, paid for by broadening the base by removing exemptions and loopholes. Several additional tax principles are:

- The ideal corporate tax rate is zero. A high corporate tax rate hurts the workers more than anyone else.

- A growth-oriented tax system taxes consumption, not income and savings.

- Eliminating or moving away from taxing income, would lessen the value of personal deductions such as for mortgage interest or charitable donations.

- The estate tax is a particularly distorting tax on saving and investment. The tax code should not give strong incentives to middle-age people to stop building their businesses or investing their money.

- Solving our immigration problem would turn 11 million illegal immigrants into productive citizens. Guest worker and e-Verify enforcement are fixable problems.

How to speed up economic growth ought to be one of the basic issues in the presidential election campaign. Here are some good ways to do this.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3