I have been writing this blog, “It Does Not Add Up” for three years now. It deals with fiscal and economic policy at the national level. Of the many problems in this area, there is one which looms larger than all the others. It is our out-of-control annual deficit spending which is in turn leading to a rapidly exploding national debt, now roughly $13 trillion or 74% of GDP.

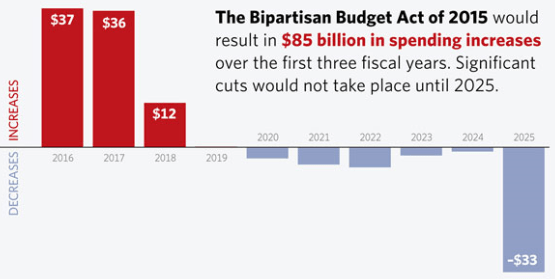

My last post considers the details of the recently passed 2016 Federal Budget and how it will add $158 billion to the deficit in just 2016 alone. The Committee for a Responsible Federal Budget estimates that the 10 year total in additional debt will be about $1.7 trillion.

My last post considers the details of the recently passed 2016 Federal Budget and how it will add $158 billion to the deficit in just 2016 alone. The Committee for a Responsible Federal Budget estimates that the 10 year total in additional debt will be about $1.7 trillion.

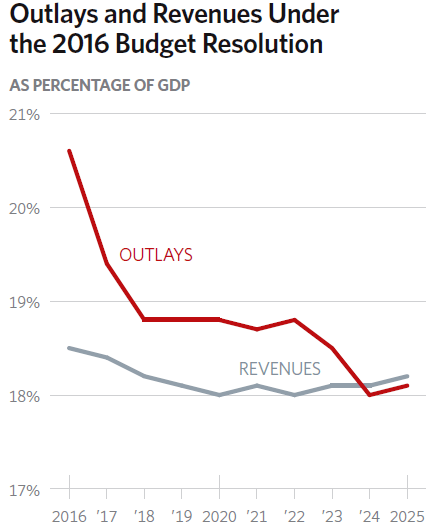

As the above chart shows, such a huge additional debt in just ten years will lead to a total public debt in 2040 equal to 175% of GDP. Such an enormous debt is obviously unsustainable and will almost surely lead to a new, and much worse, financial crisis long before the year 2040 arrives.

As the chart also shows, we need to be moving in exactly the opposite situation to keep our debt under any semblance of control. Reducing deficit spending by $2 trillion over the next ten years would serve to “stabilize” the debt at 72% of GDP in 2025.

To actually end deficit spending, and therefore balance the budget, would require reducing the deficit by a total of $5 trillion over ten years. This is exactly what the Republican Budget Resolution from Spring 2015 proposed to do. Needless to say, this desirable goal has fallen by the wayside.

The Republicans are promising a fresh start and better process next year. We can only hope that they are more successful in the new year.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3