I have been writing this blog for just over a year. It addresses what I consider to be the two biggest problems faced by our country at the present time. First is our enormous national debt, now over $17 trillion, and the huge annual budget deficits which are continuing to make it worse. The second problem, of equal magnitude, is our slow rate of economic growth, about 2% of GDP annually, ever since the Great Recession ended in June 2009.

These two problems are closely related. If the economy grew faster, federal tax revenue would grow faster and the annual deficit would shrink faster. Not to mention that a faster growing economy would create more jobs and lower the unemployment rate, which is still a high 7%.

These two problems are closely related. If the economy grew faster, federal tax revenue would grow faster and the annual deficit would shrink faster. Not to mention that a faster growing economy would create more jobs and lower the unemployment rate, which is still a high 7%.

The impediments to solving these problems are huge. Our public debt, on which we pay interest, is now over $12 trillion or 73% of GDP. Although it may stabilize at this level for a few years, it will soon begin climbing much higher, without major changes in current policy. This is primarily because of exploding entitlement spending for retirees (Social Security and Medicare) who will increase in number from about 50 million today to over 70 million in just 20 years. As interest rates return to normal higher levels, just paying interest on the national debt will become, all by itself, a larger and larger drain on the economy.

The impediments to faster economic growth are increasing global competition, such as inexpensive foreign labor, as well as rapid advances in technology, such as electronics and robotics. Both of these trends reduce the need for unskilled workers in America which in turn holds down wages and slows down economic growth.

At the same time we have an antiquated tax code to raise the huge sums of money necessary to pay for a large and complex national government. It worked fine through the post-World War II period, as long as the U.S. had the dominant world economy with little significant competition from others. But this situation no longer exists. We now have a tax system which doesn’t raise enough money to pay our bills and at the same time is so progressive that the highest rates (39.6% on individuals and 35% for corporations) are not sufficiently competitive with other countries. This discourages the entrepreneurship and business investment we need to grow the economy faster and create more jobs.

We have an enormous problem on our hands! Is it possible to fundamentally change our tax system to turn things around? My next post will answer this question in the affirmative!

Category Archives: deficit

Oklahoma’s Senator Tom Coburn: We Need More like Him!

Senator Tom Coburn of Oklahoma has an Op Ed column in the Wall Street Journal from two days ago “The Year Washington Fled Reality”, discussing many of the things that are wrong with our national government. Granted that all elected officials “play politics” to some extent or another, nevertheless Dr. Coburn, an obstetrician, is amazingly independent of the reigning political culture. He spent three consecutive terms in the House of Representatives, left Congress for four years, and now is back serving his second term in the Senate. He has announced that he will not run for re-election in 2016 when his present term ends.

Dr. Coburn is constantly drawing attention to, and attacking, the enormous amount of wasteful and inefficient spending approved by Congress. The Popular Romance Project, pictured above, is an example. His office has just published its fourth annual report on government waste, “Wastebook 2013”, detailing 100 different “examples of government mismanagement and stupidity. … Collectively these cost nearly $30 billion in a year when Washington would have you believe everything that could be done, has been done to control unnecessary spending.”

Dr. Coburn is constantly drawing attention to, and attacking, the enormous amount of wasteful and inefficient spending approved by Congress. The Popular Romance Project, pictured above, is an example. His office has just published its fourth annual report on government waste, “Wastebook 2013”, detailing 100 different “examples of government mismanagement and stupidity. … Collectively these cost nearly $30 billion in a year when Washington would have you believe everything that could be done, has been done to control unnecessary spending.”

Dr. Coburn has prevailed upon the Government Accounting Office to issue annual reports called “Actions Needed to Reduce Fragmentation, Overlap and Duplication and Achieve Other Financial benefits.” Three of these reports have now been issued. Altogether they list almost 400 individual actions which could be taken to improve the efficiency and effectiveness of 162 different program areas.

In spite of all the good work he is doing, Dr. Coburn would be even more effective if he had more help. Fiscal conservatives should stop wasting their time on senseless gestures like trying to defund Obamacare. They need to get down in the trenches with serious deficit hawks like Tom Coburn and whittle away at wasteful programs one by one.

How Do We Fight Economic Inequality? By Restoring Growth!

The liberal economist Paul Krugman returns to one of his favorite topics in yesterday’s New York Times, “Why Inequality Matters”. “On average, Americans remain a lot poorer today than they were before the economic crisis. For the bottom 90 percent of families, this impoverishment reflects both a shrinking economic pie and a declining share of that pie.” The problem with Mr. Krugman’s analysis is that he offers no solution beyond more fiscal stimulus: “the premature return to fiscal austerity has done more than anything to hobble the recovery.”

But there is another route to recovery and it is propounded in today’s Wall Street Journal by George Osborne, the United Kingdom’s Chancellor of the Exchequer, “How Britain Returned to Growth”. “We cut spending and top tax rates, and now deficits are down and jobs are being created at a healthy clip … at the rate of 60,000 per month, roughly equivalent to 300,000 in the U.S. … The corporate tax rate is being cut to 20% from 28%. … As a result, more international firms are moving their headquarters to Britain and investment is flowing into our country.”

But there is another route to recovery and it is propounded in today’s Wall Street Journal by George Osborne, the United Kingdom’s Chancellor of the Exchequer, “How Britain Returned to Growth”. “We cut spending and top tax rates, and now deficits are down and jobs are being created at a healthy clip … at the rate of 60,000 per month, roughly equivalent to 300,000 in the U.S. … The corporate tax rate is being cut to 20% from 28%. … As a result, more international firms are moving their headquarters to Britain and investment is flowing into our country.”

Yes, as Mr. Krugman says, economic inequality in the U.S. is bad and getting worse. The question is what to do about it. Shall we try to improve the situation with artificial stimulation, increasing government debt, already very high, for future generations? Or shall we address this inequality by encouraging businesses to grow and expand and thereby raise wages and hire more people.

The good news is that America is the success story of the 20th century. The bad news is that everyone else in the world has figured this out and is now copying our own best methods. Either we can compete, innovate, stay on top and thrive, or else we can get lazy, stagnate and sink down in the pack.

Will it be more inequality or more growth? The choice is up to us!

Why Is It So Hard For Congress To Do Its Job?

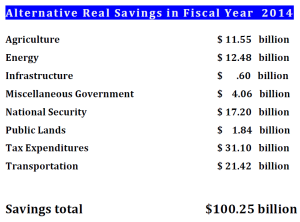

In response to the recent budget deal which has already passed the House of Representatives, Taxpayers for Common Sense has issued a new report “Real Savings, Real Deficit Reduction: Relieving Budget Caps with Common Sense Savings in Fiscal Year 2014”, showing how $100 billion could be cut from the federal budget for fiscal 2014, completely offsetting the supposedly onerous cuts required by the sequester. Here is a summary of what TCS has come up with:

Of course there are many ways to achieve $100 billion in savings in a single year and this is only one particular way to do it. But it is a balanced plan making roughly comparable cuts from many different agencies and also including a significant amount of tax expenditure savings. It would, of course, be much better to also include adjustments to entitlement spending such as Social Security and Medicare. A big reason for keeping the sequester in place, or offsetting it with equivalent cuts, as TCS is suggesting, is to create more interest in making necessary changes in entitlement programs.

Yet another way of accomplishing the same goal would be to keep the sequester spending levels in place but to give each government agency the authority to rearrange the spending cuts within its only agency. This is what management should be doing anyway on a routine basis.

It is very disappointing that Congress will not do the job, one way or another, that is required to operate the government on a sound financial basis. Let’s hope that the voters make big changes in the elections coming up in 2014!

Is a Bad Deal Better Than No Deal At All?

Beltway insiders are praising the just announced budget deal between the Democrats and the Republicans. For example, a news analysis in today’s Wall Street Journal, “Accord Is Departure for Capitol”, suggests that budget politics may be changing, getting any deal is very hard, that perhaps bipartisanship isn’t dead in Washington but that there is still unfinished business. This is a purely euphemistic assessment. All this deal really does is to let the big spenders off the hook.

What it does is to relax the sequester by $63 billion for the next two years for very little in return. The $84 billion in new fees over ten years “officially” reduces the deficit by $21 billion but two year’s worth of new fees is just $16.8 billion. This means that the deficit will actually increase by $46 billion over the next two years.

But the real problem is that the leverage represented by the sequester is being thrown away for the next two years and this sets a bad precedent for the future. For example, we can now assume that the debt limit will also be raised for two more years in February 2014 because there will no longer be any leverage for bargaining for any other changes.

This in turn means that entitlement reform is for all practical purposes dead for the next two years. This is the really hard problem to solve. Big spenders will do anything to avoid dealing with it. Responsible fiscal conservatives know it must be addressed and need all the help they can muster to get something done.

What happens if the budget deal is not passed by Congress? It simply means that the sequester remains in effect and that discretionary spending will be $43 billion lower this current budget year than otherwise. The value of the sequester is to force action on the really thorny issue of reducing entitlement spending. Let’s preserve it for this purpose and not throw it away for nothing significant in return.

Leaders are supposed to address issues, not walk away from them!

How to Get the Economy Back on Track

Harvard Economist, Martin Feldstein, has an Op Ed column in yesterday’s New York Times, “Saving The Fed From Itself”, which gets our current economic situation half right. First of all, Mr. Feldstein says that the Fed’s quantitative easing policy is inadequate because “the magnitude of the effect has been too small to raise economic growth to a healthy rate. … The net result is that the economy has been growing at an annual rate of less than 2 percent. … Weak growth has also meant weak employment gains. … Total private sector employment is actually less than it was six years ago. … While doing little to stimulate the economy, the Fed’s policy of low long-term interest rates has caused individuals and institutions to take excessive risks that could destabilize the economy just as it did before the 2007-2009 recession.” So far he’s right on the button!

But then he goes on to say, “To get the economy back on track,” Congress should enact a five year plan to spend a trillion dollars or more on infrastructure improvement and that this would “move the growth of gross domestic product to above three percent a year.” An artificial stimulus like this might work temporarily but then it ends and we’re back where we started. We need a self-generating stimulus that will keep going indefinitely on its own. How do we accomplish this?

The answer should be obvious. We do it by stimulating the private sector to take more risk in order to generate more profits. In the process they will hire more employees and boost the economy.

How do we motivate the private sector? By lowering tax rates and loosening the regulations which stifle growth. Closing tax loopholes and lowering deductions (which will raise revenue to offset the lower tax rates) has the added benefit of attacking the corporate cronyism which everyone deplores.

We really do need to put first things first. If we can jump start the economy by motivating the private sector to invest and grow, we will have more tax revenue to spend on new and expanded government programs as well as shrinking the federal deficit.

Why is this so hard for so many people to understand?

Global Warming Is For Real. What Should We Do About It?

Although the threat of global warming is vastly overhyped, it is happening nonetheless. Perhaps the best single indication of this is the shrinking of the north-pole ice cap. The New York Times reported just a few days ago, “Large Companies Prepared to Pay Price on Carbon”, that at least 29 major companies “are incorporating a price on carbon into their long-range financial plans.” This includes five big oil companies ExxonMobil, ConocoPhillips, Chevron, BP and Shell. Specifically, these major companies have all come to accept the reality of global warming and are preparing for a carbon tax to be levied before long.

The Congressional Budget Office has recently released a report “Effects of a Carbon Tax on the Economy and the Environment”, which concludes that a tax of $20 to emit a ton of CO2 would raise a total of $1.2 trillion over a decade. Such a tax would, for example, raise the price of gasoline by 10 to 15 cents per gallon.

Once we admit that global warming is for real, and that we need to address it in a serious way, a carbon tax is almost certainly the most efficient, and least economically harmful, way to do it. A tax on carbon output would do many things. It would give a big boost to renewable energy (solar and wind) with, or without, special subsidies for renewables. It would speed up the transformation from the use of coal to natural gas, since natural gas only contains half as much carbon as coal does. And it would create an economic incentive to speed up the development of carbon capture in order to make the burning of coal more cost competitive.

Of course, a new $120 billion per year carbon tax will affect the economy. But it will do the least damage if the proceeds are used entirely for deficit reduction. So we can address a serious environmental problem which effects life on earth and can do so in a way which also addresses a very serious fiscal problem.

I believe that the American people are up to making a sacrifice like this if the consequences of inaction are clearly explained to them.