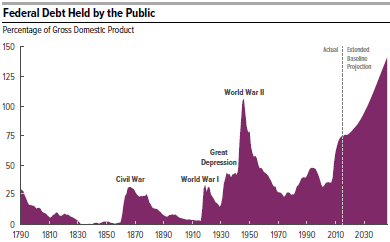

As a fiscal conservative, I am worried about our nation’s future. The public debt (on which we pay interest) is now 75% of GDP, the highest level since right after WWII, and growing steadily. Furthermore, our economy has just barely recovered from the Great Recession and is expanding too slowly to revive widespread prosperity. Neither of the two main presidential candidates, Hillary Clinton nor Donald Trump, is talking seriously about our huge debt and neither has a credible plan to boost economic growth.

The above chart from the Heritage Foundation is a vivid way of illustrating this problem:

- Already entitlement spending (Social Security, Medicare and Medicaid), and interest payments on our debt, use up 2/3 of all federal tax revenue. And spending on each of these entitlement programs is growing faster than the economy as a whole. Interest rates will eventually rise from their current rock bottom level. When this happens, interest payments on our growing debt will increase rapidly.

- In 2032, just 16 years from now, spending on entitlements and interest payments is projected to consume all federal tax revenues, assuming a steady 18% of GDP level for tax revenue.

There are three possible ways to offset this bleak picture:

- Speed up economic growth. This should, of course, be possible but it will take a major shift in thinking to accomplish.

- Increase federal tax revenue. Suppose that federal tax revenues were raised by 1% of GDP, or $180 billion per year. This would at least temporarily put our debt on a downward path (as a percentage of GDP). But it would be very hard to accomplish politically. Mrs. Clinton, for example, has proposed raising taxes by $100 billion per year which she wants to spend entirely on new programs rather than reducing our annual deficits.

- Reform entitlement programs. This is by far the best way to address our debt problem, and the only effective way in the long run. But, again, it will be very hard to accomplish politically.

Conclusion. If the U.S. cannot get its debt and slow growth problems under control, it risks losing its status as the world’s major superpower. This would be a calamity for both our own national security and the peace and stability of the entire world.