How to grow the economy faster. How to get our rapidly growing national debt under control. These are the two main problems facing our country which I address over and over again on this blog. Finding satisfactory solutions to these two problems will determine our future strength and prosperity as a nation. Today’s discussion is about the major cause of our debt and deficit problem.

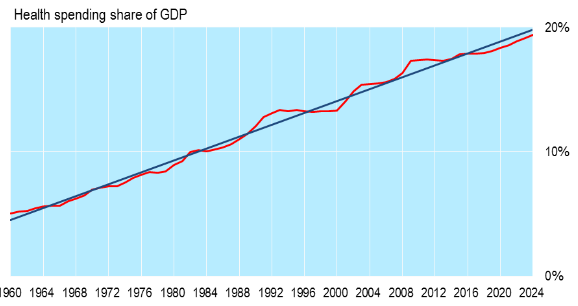

I recently came across the above chart showing the steady rise of overall American healthcare spending (public and private). In 1960 it was less than 6% of GDP. Now it is approximately 18%, a tripling, compared to the overall size of the economy, in just 55 years. Of course it is the cost of public healthcare programs such as Medicare, Medicaid and the Affordable Care Act which directly contribute to our growing deficits and to the accumulated debt.

I recently came across the above chart showing the steady rise of overall American healthcare spending (public and private). In 1960 it was less than 6% of GDP. Now it is approximately 18%, a tripling, compared to the overall size of the economy, in just 55 years. Of course it is the cost of public healthcare programs such as Medicare, Medicaid and the Affordable Care Act which directly contribute to our growing deficits and to the accumulated debt.

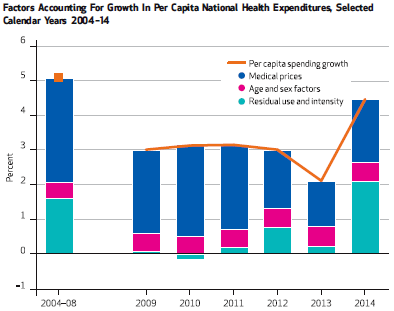

However we will never be able to limit the cost increases of these public programs until we get the fundamental drivers of private healthcare costs under control. As pointed out (in the chart below) by several scholars from the American Enterprise Institute, the basic reason for the high cost of private American health care is that “we don’t have enough skin in the game” as shown by the chart just below. We are paying less and less of total healthcare costs out of our own pockets because more costs are paid directly by third party insurers. This means we have less incentive to control our own healthcare costs.

The AEI has suggested several reform measures to improve this situation such as:

The AEI has suggested several reform measures to improve this situation such as:

- Placing an upper limit on the tax exemption for employer-paid insurance premiums.

- Expanding the use of Health Savings Accounts to be used in conjunction with high deductible plans.

We have a stark choice in front of us. Either we move in this direction in the near future or we will face another, much worse, financial crisis. In the latter case we will end up with an inferior healthcare system, much less responsive to our wants and desires.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3