An extraordinary new book has just been published by the Pew Research Center’s Paul Taylor, “The Next Generation: Boomers, Millennials and the Looming Generational Showdown”, describing huge demographic changes which are already beginning to wash across the American political landscape. They are in brief outline:

- The retirement explosion. Today’s 45 million aged 65+ population will increase to 70 million by 2030.

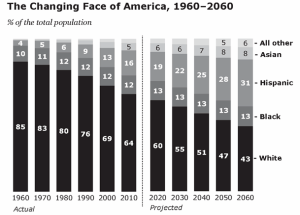

- The color explosion. Today’s 65% Caucasian population will likely shrink to 43% by 2060.

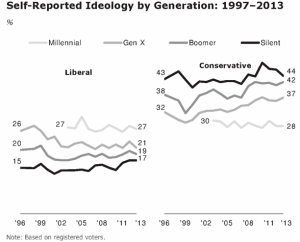

- The ideology gap. The four current American generations; the Silents, the Boomers, the Gen Xers, and the Millennials are increasingly less conservative and more liberal.

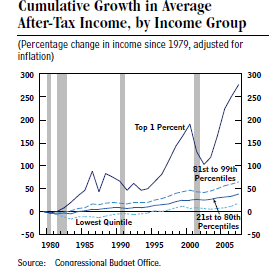

- The inequality gap. Both income and wealth inequality are growing rapidly and this trend is likely to continue.

Each of these trends is firmly established by data as shown in the accompanying charts. There are huge political implications for these mega-trends. For starters, the biggest threat to our nation’s finances is the rapidly increasing cost of entitlements, especially Social Security and Medicare. Where will the political will to control this spending come from when there are ever more retirees who want to keep their benefit programs?

With a surging immigrant population, primarily Hispanic and Asian, constantly gaining more political clout, it becomes more and more urgent to move our 12 million undocumented aliens out of the shadows with some kind of legal status. A broad based guest worker program would be a good way to get started.

With a surging immigrant population, primarily Hispanic and Asian, constantly gaining more political clout, it becomes more and more urgent to move our 12 million undocumented aliens out of the shadows with some kind of legal status. A broad based guest worker program would be a good way to get started.

The ideology gap is more difficult to interpret. The four groups are more conservative than liberal and people in general become more conservative as they grow older. Nevertheless, there is an overall trend towards liberalism as age decreases.

The ideology gap is more difficult to interpret. The four groups are more conservative than liberal and people in general become more conservative as they grow older. Nevertheless, there is an overall trend towards liberalism as age decreases.

Finally, the growing inequality gap will inevitably create much resentment if ignored by our political system.

Finally, the growing inequality gap will inevitably create much resentment if ignored by our political system.

Each of these four mega-trends will create pressure for more federal spending to address the needs and interests of various segments of society. We already have huge deficits, and rapidly increasing national debt, to contend with. How do we balance the pressure for more spending with the need for fiscal restraint? Stay tuned!

Each of these four mega-trends will create pressure for more federal spending to address the needs and interests of various segments of society. We already have huge deficits, and rapidly increasing national debt, to contend with. How do we balance the pressure for more spending with the need for fiscal restraint? Stay tuned!