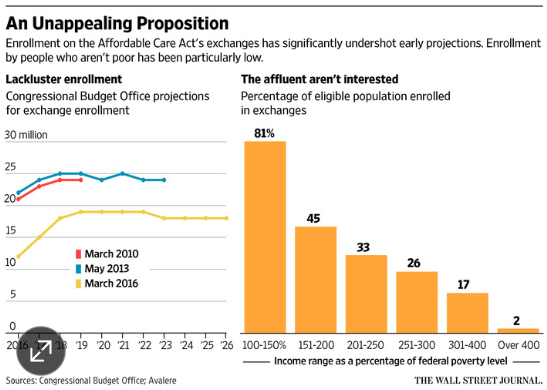

My last two posts, here and here, have discussed major intrinsic problems with the Affordable Care Act. It has been set up in an actuarially unsound manner and the cost of insurance coverage through the exchanges is growing very fast.

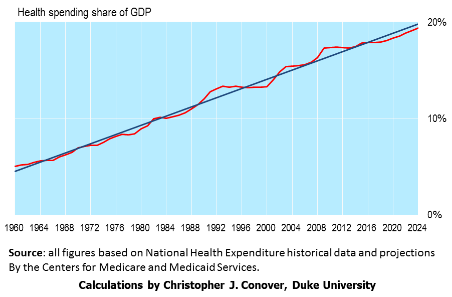

The rapidly rising cost of American health care, public and private, is in fact one of our country’s biggest problems. It is an affordability issue for millions of American households. Furthermore the rapidly rising cost of the entitlement programs of Medicare and Medicaid is the fundamental driver of our exploding national debt problem.

The rapidly rising cost of American health care, public and private, is in fact one of our country’s biggest problems. It is an affordability issue for millions of American households. Furthermore the rapidly rising cost of the entitlement programs of Medicare and Medicaid is the fundamental driver of our exploding national debt problem.

As I see it there are two different routes we can take to solve this problem. One way is to move towards a true free-market approach where healthcare consumers (all of us!) have more “skin in the game” in the sense that we move away from third party payment for routine care. It is quite interesting that this is already starting to happen under Obamacare!

The other way of getting costs under control is to adopt a single-payer system, like much of the rest of the developed world. But this would necessarily involve stringent cost controls and severe rationing and would be a lot more difficult than just enrolling everyone in Medicare. For example:

- American doctors and nurses are very well paid. The average family physician in the U.S. earns $207,000, double the rate for general practitioners in Great Britain, which has a single-payer system. Are we going to arbitrarily chop doctor salaries in half in order to control costs?

- The State of Vermont recently backed away from implementing its own single-payer system because the needed tax increases would have more than doubled Vermont’s annual budget. Colorado will vote in November on a petition-supported single-payer proposal, ColoradoCare, which would be paid for by a $26 billion annual state tax increase, and is therefore unlikely to pass. For a state to implement its own single-payer system at least requires budget honesty, since all states are required to balance their budgets. There is no such requirement for our federal government and so a single-payer system would be financed just like Medicare, with deficit spending. Bad idea!

Conclusion. American healthcare needs radical reform but adopting a single-payer system is not the best way to do it.

Follow me on Twitter

Follow me on Facebook