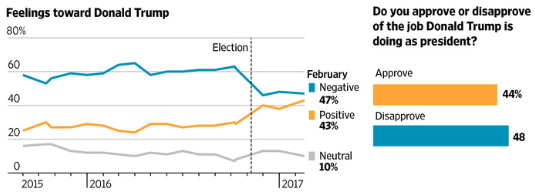

The anti-Trump fervor seems to be slowly dying down as his appointees take hold of their agencies and begin to promulgate new policies. I have expected this to happen because of the excellent quality of many of the people he has appointed.

Here are a few recent developments:

- Interior Secretary Ryan Zinke has said that “the border is complicated as far as building a physical wall” and there are all sorts of problems to be resolved before it can be done.

- Reality is setting in with regard to Russia policy “given Russia’s continued provocations in terms of weapon’s deployments, overtures to Iran, cyber intrusions and intervention in Ukraine.”

- The Brookings Institution has just issued a new report showing that school choice options are increasing in the country’s largest school districts. This indicates that Education Secretary Betsy DeVos is in the mainstream by supporting more choice.

- Coal jobs Trump vows to save no longer exist. In other words, cancelation of the Obama Clean Power Plan will have little effect on the huge drop in coal use because coal has become so much more expensive than natural gas.

- Of course, the Trump 2018 Budget Proposal will be heavily modified by Congress but it does contain some good ideas. Agriculture, Foreign Aid and Community Development Block Grants are all ripe for big cuts.

- The biggest unknown with respect to administrative action concerns trade policy. The question here is what concessions he can get from China and Mexico without starting a disastrous trade war.

What is mainly lacking at this point is any significant action by Congress on the Trump agenda. What will happen with healthcare reform, tax reform and deficit reduction, for example?

Conclusion. Trump is doing fine so far but it is on relatively straightforward issues under his control. Hopefully he will be able to make progress on the bigger issues as well which require working with Congress.

Follow me on Twitter

Follow me on Facebook