In my last post, “Status Quo on the Budget Is Not Good Enough,” I discussed a report from the outgoing chair of the Senate Budget Committee, Patty Murray (D-WA), and explained how it epitomizes the lack of progress made on the massive debt problem which has developed since the Great Recession of 2008 -2009.

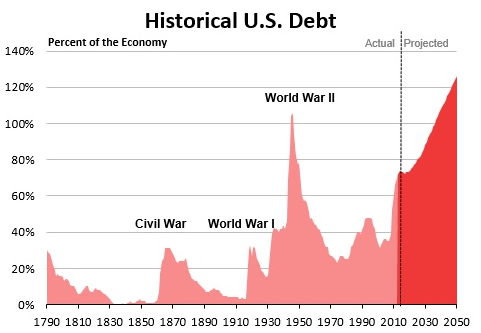

The basic problem is that Senator Murray’s analysis simply does not recognize the seriousness of our debt problem as shown in the above chart. Right now our public debt (on which we pay interest) is “sitting” at 74% of GDP for a year or two, before it continues its rapid increase. This projection assumes an historically “normal” growth rate of 3% and no new recessions, neither of which assumption is assured. It also assumes that the sequester budget cuts and new top tax rate of 39.6% stay in effect. In other words it is a best case scenario based on current policy.

The basic problem is that Senator Murray’s analysis simply does not recognize the seriousness of our debt problem as shown in the above chart. Right now our public debt (on which we pay interest) is “sitting” at 74% of GDP for a year or two, before it continues its rapid increase. This projection assumes an historically “normal” growth rate of 3% and no new recessions, neither of which assumption is assured. It also assumes that the sequester budget cuts and new top tax rate of 39.6% stay in effect. In other words it is a best case scenario based on current policy.

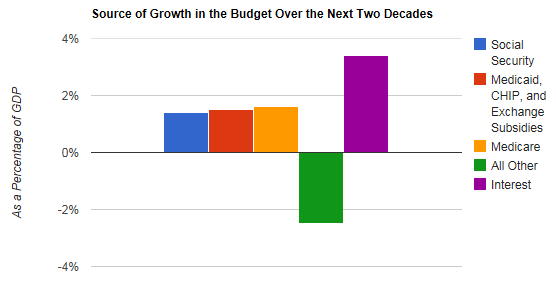

Breaking it down, the debt will continue to increase because annual deficits will continue to exceed the rate of growth of the economy. The main driver of these increasing deficits is the cost of the health care entitlements of Medicare and Medicaid. Medicare costs will increase rapidly because of the aging of the American people. Medicaid costs will increase rapidly because: 1) more low-income people are being covered by the ACA and 2) since the recession there are more low-income people to be covered. I certainly support expanded healthcare coverage but we have to figure out how to pay for it!

How do we contain the increasing costs of Medicare and Medicaid? We do it by controlling the overall rapid growth (at twice the rate of inflation) of healthcare costs in general, i.e. for private healthcare. How do we do this? See a couple of my recent posts either here or here.

Senator Murray, along with many other progressives, argues that we need more deficit spending in order to stimulate the economy and create new jobs. More jobs are badly needed but more deficit spending is the wrong way to get them. Then how? With tax reform among other things.

Based on the outcome of the 2014 elections, I am optimistic that something along the lines of what I have just described will be tried by the next Congress. We’ll soon find out!