“Low interest rates aren’t working, but we need a debate about what will,” declares The Wall Street Journal’s William Galston yesterday in “Soaring Profits but Too Few Jobs”. “Corporate profits after taxes in the fourth quarter of 2013 rose to an annual level of $1.9 trillion – 11.1% of GDP, a postwar high. Meanwhile, total compensation – wages and benefits – fell to their lowest level of GDP in at least 50 years.”

“Businesses are sitting on tons of cash . . . and they’re choosing to invest their capital in hardware, rather than hiring. The reason: they believe that investing in technology is likely to have a better effect on sales than hiring more people.” Furthermore, “today’s (low) interest- rate regime lowers the cost of capital – and therefore of capital investment relative to labor.”

“Businesses are sitting on tons of cash . . . and they’re choosing to invest their capital in hardware, rather than hiring. The reason: they believe that investing in technology is likely to have a better effect on sales than hiring more people.” Furthermore, “today’s (low) interest- rate regime lowers the cost of capital – and therefore of capital investment relative to labor.”

Meanwhile,” Republicans are banging away at the Affordable Care Act while Democrats are busy scheduling votes on a grab bag of subjects designed to boost turnout from the party’s base in the fall elections. The economic problems we face are getting lost in the partisan din.”

We are in a very tough situation. Raising interest rates might give a marginal boost to hiring more workers over capital investment but it will also greatly increase interest payments on our massive and rapidly increasing national debt. And meanwhile we have a stagnant economy with millions of people either unemployed or underemployed. What should we do? How about

- Boosting the economy with lower individual and corporate tax rates, paid for by cutting back on tax preferences. This will especially help small businesses grow and hire more employees. It will also encourage multinational corporations to bring their foreign profits back home for reinvestment.

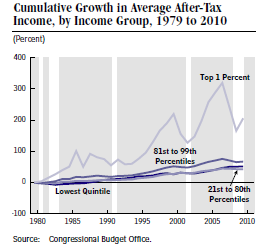

- Addressing rising income and wealth inequality by establishing an annual 1% wealth tax on individual assets in excess of $10 million. This will raise about $200 billion per year and could be used to set up a huge infrastructure improvement program to put millions of people back to work.

Interest rates will eventually return to normal levels of 5% or so and this will create a big squeeze on the federal budget. So we also need to get federal spending under control as soon as possible. But this is a separate issue.

Just boosting the economy and putting people back to work while addressing inequality in a very visible way will get us started on a path to recovery.