I discuss two fundamental economic and fiscal problems on this website:

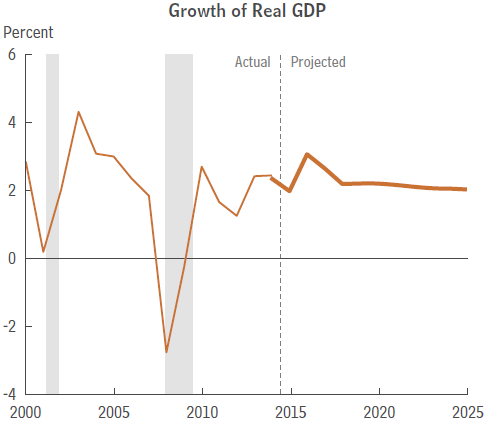

- The slow growth of our economy, only 2.1% per year since the end of the Great Recession in June 2009. This is largely responsible for stagnant wages for middle- and low-income workers, which is in turn responsible for the rise of the populist presidential candidates Bernie Sanders and Donald Trump.

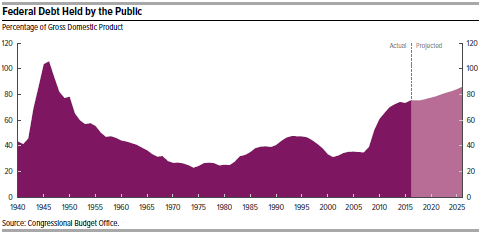

- Our massive national debt, now 74% of GDP for the so-called public part, on which we pay interest. This is the highest it has been since right after WWII.

Slow economic growth gets more public attention because of its direct and negative effect on so many people. However massive debt is more of an existential problem. Right now our debt is almost “free” money because interest rates are so low. But with debt predicted (by the Congressional Budget Office, for example) to keep climbing steadily under current policy (see the first chart) and with the inevitability of increased interest rates in the future, interest payments on the public debt are bound to rise precipitously.

The second chart just above (from the Concord Coalition) shows that interest payments on the debt will likely soon become the leading source of growth in federal spending. But perhaps surprising is that the three non-interest sources of spending growth are the entitlement programs, Medicare, Social Security and the combined Medicaid, CHIP and ACA exchange subsidies. All other government spending will decrease in relative terms.

The second chart just above (from the Concord Coalition) shows that interest payments on the debt will likely soon become the leading source of growth in federal spending. But perhaps surprising is that the three non-interest sources of spending growth are the entitlement programs, Medicare, Social Security and the combined Medicaid, CHIP and ACA exchange subsidies. All other government spending will decrease in relative terms.

Is it not readily apparent from this data that the only way to curtail a huge fiscal crisis in the not so distant future is to get entitlement spending under much better control? The last chart, just above, (from the Trustees of SS and Medicare) shows the growth in general fund revenue required for Medicare and SS going forward. In 2016 the discrepancy is 2.1% of GDP which amounts to $401 billion. The discrepancy will double by 2040. Of course, OASDI (SS) and HI (Medicare Part A) have trust funds paid into by payroll taxes. But these trust funds are already paying out more than they take in and will be exhausted in a few years.

Is it not readily apparent from this data that the only way to curtail a huge fiscal crisis in the not so distant future is to get entitlement spending under much better control? The last chart, just above, (from the Trustees of SS and Medicare) shows the growth in general fund revenue required for Medicare and SS going forward. In 2016 the discrepancy is 2.1% of GDP which amounts to $401 billion. The discrepancy will double by 2040. Of course, OASDI (SS) and HI (Medicare Part A) have trust funds paid into by payroll taxes. But these trust funds are already paying out more than they take in and will be exhausted in a few years.

Conclusion. Spending on entitlement programs must be brought under much better control. How to do this will be the topic of my next post.

A new report from the

A new report from the