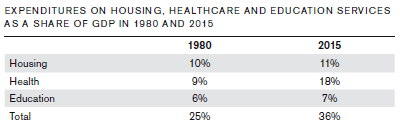

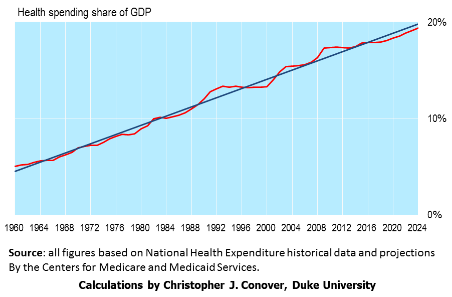

Straightening out healthcare insurance is a high priority for the new Trump Administration and Congress as it should be. The U.S. spends 18% of GDP on healthcare, public and private, twice as much as any other developed country and this percentage is likely to keep on increasing without major changes.

Republican thought is converging, see here and here, on a plan with these broad features:

- Repeal of both the individual and employer mandates so that health insurance can be individually tailored and purchased at a much lower cost than under the ACA.

- A Universal (and refundable) tax credit sufficient to pay for catastrophic insurance coverage.

- Health Savings Accounts to pay for routine healthcare expenses up to the deductible for catastrophic insurance. Such HSAs could be funded, at least initially, with (refundable) tax credits.

- High risk pools and coverage for pre-existing conditions. It is estimated that 500,000 people with pre-existing conditions would need protection if the ACA is repealed. This would cost about $16 billion annually, much less than the full cost of the ACA.

Conclusion. Such a plan will insure coverage for all Americans who want it. The high deductibility feature, coupled with HSAs, will strongly encourage healthcare consumers to shop around for the best price on routine care. Such price consciousness by consumers is the only way (short of a single payer system with severe rationing) to get our national healthcare costs under control.

A modification of such a plan, proposed by Senator Bill Cassidy (R, LA) and Senator Susan Collins (R, ME) would give each state the choice of either keeping the ACA or replacing it with a version of the above plan. This is a poor idea because the ACA has no cost control and this is what is sorely needed. In other words, the above plan should be made universal, identical for all states. Let the states provide and pay for supplemental coverage if they wish.

Follow me on Twitter

Follow me on Facebook