Last week I summarized the latest economic report from the Congressional Budget Office which very clearly describes both the slow rate of growth of our economy since the end of the recession, the enormous buildup of our national debt in the past five years and also the likelihood that it will continue getting worse for the foreseeable future unless big changes are made.

About a week ago the two economists Edward Prescott and Lee Ohanian had an Op Ed in the Wall Street Journal, “U.S. Productivity Growth Has Taken a Dive”, pointing out that the productivity of U.S. workers has grown at an average annual rate of only 1.1% since 2011, much lower than the average annual rate of about 2.5% since 1948 (see the above chart). They also point out that the rate of new business creation is 28% below where it was in the 1980s (see the chart just below). Growth of worker productivity and growth of new business formation are the two main forces which drive economic growth.

About a week ago the two economists Edward Prescott and Lee Ohanian had an Op Ed in the Wall Street Journal, “U.S. Productivity Growth Has Taken a Dive”, pointing out that the productivity of U.S. workers has grown at an average annual rate of only 1.1% since 2011, much lower than the average annual rate of about 2.5% since 1948 (see the above chart). They also point out that the rate of new business creation is 28% below where it was in the 1980s (see the chart just below). Growth of worker productivity and growth of new business formation are the two main forces which drive economic growth.

“Why is the startup rate so low? The answer lies in Washington and the policies implemented in the wake of the 2008 financial crisis that were, ironically, intended to grow and stabilize the economy.” Mr. Prescott and Mr. Ohanian continue that it is the “explosion in federal regulation, intervention and subsidies (which) has retarded productivity growth by protecting incumbents at the expense of more efficient producers, including startups.”

“Why is the startup rate so low? The answer lies in Washington and the policies implemented in the wake of the 2008 financial crisis that were, ironically, intended to grow and stabilize the economy.” Mr. Prescott and Mr. Ohanian continue that it is the “explosion in federal regulation, intervention and subsidies (which) has retarded productivity growth by protecting incumbents at the expense of more efficient producers, including startups.”

It is easy to be pessimistic about the prospects for change in the government policies which are retarding economic growth. Unfortunately, many political and social leaders have the point of view that it is income inequality which is “the defining issue of our time.”

The best response to this pervasive attitude is to shift the conversation towards equality of opportunity rather than dwelling on income inequality. By far the best way to increase opportunity for those who desire it and are willing to work for it is to grow the economy faster in order to create more and better jobs. If we are able to do this, we’ll all be much better off.

Tag Archives: jack heidel

The Economic Outlook: 2014 – 2024 I. The Basic Data

The Congressional Budget Office has just issued the report ”The Budget and Economic Outlook: 2014 to 2024”, giving its usual objective and nonpartisan look at our prospects for the next ten years. My purpose today is to give a simple interpretation of its basic data. In my next post I will address the implications of this interpretation.

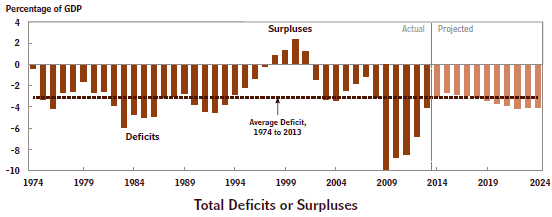

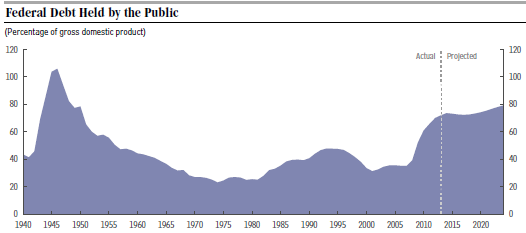

The first chart above shows a forty year history of government deficit spending. The average deficit for this time period is 3% of GDP. From 1982 – 1987 the deficits were worse than this and from 2009 – 2013 they were much worse. The real problem is the accumulated deficits, i.e. the debt. The second chart above shows the public debt (what we pay interest on) all the way back to 1940 as a percent of GDP. As recently as 2008, the public debt was below 40% of GDP. Now it is 73% and climbing. This is very serious for two reasons. Right now our public debt is almost free money because interest rates are so low. But when interest rates return to their normal level of about 5%, interest payments will explode and be a huge drain on the economy. In addition, these CBO predictions assume continued steady growth of the economy. If and when we have a new recession or some other financial crisis, there will be much less flexibility available for dealing with it.

The first chart above shows a forty year history of government deficit spending. The average deficit for this time period is 3% of GDP. From 1982 – 1987 the deficits were worse than this and from 2009 – 2013 they were much worse. The real problem is the accumulated deficits, i.e. the debt. The second chart above shows the public debt (what we pay interest on) all the way back to 1940 as a percent of GDP. As recently as 2008, the public debt was below 40% of GDP. Now it is 73% and climbing. This is very serious for two reasons. Right now our public debt is almost free money because interest rates are so low. But when interest rates return to their normal level of about 5%, interest payments will explode and be a huge drain on the economy. In addition, these CBO predictions assume continued steady growth of the economy. If and when we have a new recession or some other financial crisis, there will be much less flexibility available for dealing with it.

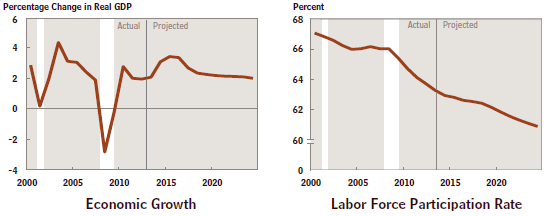

Now look at the last two charts. The first one shows the rate of GDP growth since 2000 which has averaged about 2% since the end of the recession in June 2009 and is projected by the CBO to level off at this same rate over the next 10 years. This is an historically low rate of growth for our economy. The final chart shows the gradual decrease of the labor force participation rate over this same time period. These two graphs are related! When fewer people are working, the economy simply will not grow as fast.

Now look at the last two charts. The first one shows the rate of GDP growth since 2000 which has averaged about 2% since the end of the recession in June 2009 and is projected by the CBO to level off at this same rate over the next 10 years. This is an historically low rate of growth for our economy. The final chart shows the gradual decrease of the labor force participation rate over this same time period. These two graphs are related! When fewer people are working, the economy simply will not grow as fast.

High debt and slow growth are big problems for an economy. We’re falling more deeply into this perilous state of affairs all the time. We need to take strong measures to break out of this dangerous trap!

Let’s Devolve Federal Programs Back to the States!

Yesterday’s New York Times has an article “Battles Looming Over Surpluses in Many States”, pointing out that “unexpectedly robust revenues from taxes and other sources are filling most state coffers, creating surpluses not seen in years and prompting statehouse battles over what to do with the money.” For example, in Kansas, Governor Sam Brownback is calling for full day kindergarten for all students.

This raises a larger issue. The states are recovering from the Great Recession and have lots of money. We know that states spend money far more efficiently than the federal government, because states have constitutional requirements to balance their budgets. On the other hand, the federal government is hemorrhaging red ink at a frightening rate which will just keep getting worse indefinitely until strong measures are taken. It has taken on far too many responsibilities and spends money very inefficiently.

This raises a larger issue. The states are recovering from the Great Recession and have lots of money. We know that states spend money far more efficiently than the federal government, because states have constitutional requirements to balance their budgets. On the other hand, the federal government is hemorrhaging red ink at a frightening rate which will just keep getting worse indefinitely until strong measures are taken. It has taken on far too many responsibilities and spends money very inefficiently.

All of this suggests an obvious course of action to turn around a very bad situation. We should devolve as many federal programs as possible back to the states. Here are three good ones to start with:

- Medicaid costs the federal government about $250 billion per year with another $150 billion being paid for by the states. The problem is that federal support is a fixed percentage of what the states spend. This makes Medicaid a very expensive program with no limit on the cost to the federal government. A good way to solve this problem is to “block grant” Medicaid to the states and let each state figure out the best way to spend its own federal allotment. Annual increases in the size of federal block grants could be tied to the rate of inflation in order to limit their growth.

- Education spending at the federal level is a $100 billion per year (not counting student loans) item. Just at the K-12 level alone there are over 100 individual programs to which states and school districts have to apply for funds separately. Wouldn’t it make far more sense to “block grant” education funds back to the states so that this large sum of money can be spent more effectively and efficiently by targeting it at the biggest needs in each state?

- Job-Training costs the federal government $18 billion per year for 47 different programs. Again it would be so much more sensible to block-grant job training funds to the states and measure effectiveness by the number of workers hired.

There really are relatively simple ways for the federal government to operate more effectively and at much lower cost. We need national leaders who are committed to getting this done.

Does Free Trade Increase Inequality?

Several days ago, David Bonior, a former Congressman from Michigan, wrote in the New York Times about “Obama’s Free-Trade Conundrum”. “The President cannot both open markets and close the wage gap.” There is an “academic consensus that trade flows contribute to between 10 and 40 percent of inequality increases.” This happens because “there is downward pressure on middle-class wages as manufacturing workers are forced to compete with imports made by poorly paid workers from abroad.”

But there is another point of view, provided, for example, by the report “NAFTA at 20: Overview and Trade Effects”, prepared by the Congressional Research Service about a year ago. “U.S. trade with its NAFTA partners has more than tripled since the agreement took effect (in 1993). (Canada and Mexico) accounted for 32% of U.S. exports in 2012. 40% of the content of U.S. imports from Mexico and 25% of U.S. exports from Canada are of U.S. origin. In comparison, U.S. imports from China are said to have only 4% U.S. content.” In other words, NAFTA at least has been a huge success.

But there is another point of view, provided, for example, by the report “NAFTA at 20: Overview and Trade Effects”, prepared by the Congressional Research Service about a year ago. “U.S. trade with its NAFTA partners has more than tripled since the agreement took effect (in 1993). (Canada and Mexico) accounted for 32% of U.S. exports in 2012. 40% of the content of U.S. imports from Mexico and 25% of U.S. exports from Canada are of U.S. origin. In comparison, U.S. imports from China are said to have only 4% U.S. content.” In other words, NAFTA at least has been a huge success.

Being able to trade with others is the foundation of private enterprise. Foreign trade is simply an extension of domestic trade. To limit trading opportunities with other countries would be a huge barrier to economic growth and therefore to future prosperity as well.

But at the same time we do want a more equal society as well as well as a more prosperous one. The key to resolving this “conundrum”, as Mr. Bonior puts it, is to address “opportunity inequality” as well as “income inequality.”

It is estimated that each billion dollars in U.S. exports provides employment for about 5000 workers. Nebraska, for example, exported $12.6 billion worth of goods and services in 2012 which translates into 63,000 jobs.

More jobs and better jobs are what create economic opportunity. One way to create more jobs and better jobs is to promote foreign trade by removing as many trade barriers as possible. Hopefully Congress and the President can work together to get this done!

Invested in America

The Business Roundtable, an association of chief executive officers of leading U.S. companies, has just issued a new report, “Invested in America: A Growth Agenda for the U.S. Economy”, describing four actions which policymakers can take to rejuvenate the U.S. economy.

They are:

They are:

- Restore Fiscal Stability: constrain federal spending in a manner that reduces long-term spending growth, making both Medicare and Social Security more progressive and less expensive.

- Enact Comprehensive Tax Reform: adopt a competitive, pro-growth tax framework that levels the playing field for U.S. companies competing in global markets. Several studies estimate that cutting the U.S. corporate tax rate by 10 % (e.g. from 35% to 25%) would boost GDP by 1% or more.

- Expand U.S. Trade and Investment Opportunities: pass updated Trade Promotion Authority legislation and use TPA to complete many new trade agreements which are already pending.

- Repair America’s Broken Immigration System: increase the number of visas for higher skilled workers and provide legal status for the millions of undocumented immigrants currently living in the U.S.

These are the same “big four” policy changes which many progressive business leaders as well as evenhanded think tank experts often recommend. They are really just common sense ideas which reasonable people should be able to come together on.

Isn’t it obvious that we’ll soon be in big trouble if we don’t get our enormous budget deficits under control? And that controlling entitlement spending is key to getting this done?

Isn’t it just as obviously commonsensical that even U.S. based multinational corporations will try to avoid locating business operations in countries like the United States with very high corporate tax rates?

Isn’t it likewise obvious that foreign trade is just an extension of domestic trade and that the world is better off with as much trade as possible?

Finally, the secret of a vibrant, growing economy is to encourage as much initiative and innovation as possible. Who take more initiative than the immigrants who figure out how to get here in the first place?

We don’t have to accept a sluggish economy, high unemployment and massive debt! But we do need to take intelligent action to extricate ourselves from the predicament we are in!

What Is the State of the U.S. Economy?

On the eve of the President’s State of the Union address, the New York Times gives an answer to this question in today’s paper, “Obama’s Puzzle: Economy Rarely Better, Approval Rarely Worse”. The charts below do show the basic trends all moving in the right direction. But is this good enough?

The unemployment rate is moving steadily downward but it is still a high 6.7% almost five years after the recession ended in June 2009. And this is with a labor participation rate of only 58.6%, which is historically very low.

The unemployment rate is moving steadily downward but it is still a high 6.7% almost five years after the recession ended in June 2009. And this is with a labor participation rate of only 58.6%, which is historically very low.

The budget deficit is dropping but is still unsustainably high. In the five years, 2009 – 2013, deficits have totaled $6 trillion dollars. As soon as interest rates return to their historical average of 5%, interest on this $6 trillion in new debt alone will total $300 billion per year, forever! Furthermore, the Congressional Budget Office, the most credible source of budget information, predicts that the deficit is likely to resume an inexorable climb within a few years as baby boomers retire in ever greater numbers, rapidly driving up entitlement costs.

Economic growth was stronger than expected in the last quarter of 2013 and this is a good sign. But it has averaged only about 2% since the recession ended which is very low by historical standards, in a post recessionary period.

The point is, do we really need to settle for such mediocre performance: a stagnant economy, high unemployment and massively accumulating debt? Should we just declare that in a highly competitive global economy with an ever higher premium on information and technology, that we just can’t do any better than we already are? Isn’t there some way to make our economy grow faster in order to provide more and higher paying jobs?

I think that the answer to this last question is an emphatic yes! In fact, this is what my blog is all about. Just read some of the other recent posts and let me know if you disagree with what I am saying!

A Global Perspective on Income Inequality II. Where Are the Jobs?

My last post on January 23 shows vividly what the challenges are in restoring the American middle class to the prosperity which existed up until the Great Recession hit in late 2007. The problem, of course, is the gale strength force of globalization which is lifting up low wage workers all over the developing world and creating huge competition for the many low-skilled workers in the United States.

In today’s New York Times, the former Obama Administration car czar, Steven Rattner, writes about “The Myth of Industrial Rebound” in the United States, explaining why manufacturing jobs are coming back much more slowly than other jobs. “Manufacturing would benefit from the same reforms that would help the broader economy: restructuring of our loophole-ridden corporate tax code, new policies to bring in skilled immigrants, added spending on infrastructure and, yes, more trade agreements to encourage foreign direct investment.”

The above chart shows the huge decline in manufacturing jobs relative to other parts of the economy such as the education and health sector as well as the professional and business sector. Of course, these more rapidly growing service sectors are the ones benefitting from the information technology revolution. In manufacturing, on the other hand, the low skill jobs are going overseas while the high skill jobs, using technology such as robots, are much fewer in number.

The above chart shows the huge decline in manufacturing jobs relative to other parts of the economy such as the education and health sector as well as the professional and business sector. Of course, these more rapidly growing service sectors are the ones benefitting from the information technology revolution. In manufacturing, on the other hand, the low skill jobs are going overseas while the high skill jobs, using technology such as robots, are much fewer in number.

Conclusion: in order to increase manufacturing jobs in the U.S., we better government policies, as outlined above by Mr. Rattner. But we also need to recognize that there aren’t going to be as many high skilled manufacturing jobs in the future. We are going to need much better K-12 and post-secondary educational outcomes to prepare the middle class for the high skilled service jobs which will predominate in the future.

A Global Perspective on Income Inequality

In connection with the annual World Economic Forum in Davos Switzerland, the World Bank has published a breakdown of income growth around the world, as reported yesterday by the Wall Street Journal in the article “Two-Track Future Imperils Global Growth”. The key finding, as shown in the chart below, is that it is precisely the middle class in the developed nations which saw the slowest income growth in the years from 1998-2008.

It is clear from this chart what is going on around the world. The top 1% makes its money from capital investments and historically the return on capital exceeds economic growth. The next 9% are both the skilled workers and the educated professionals who are benefitting from the growth of knowledge industry. The medium skilled middle class in the developed world, from the 75th percentile through the 90th percentiles, are the ones who are seeing the smallest income gains. Their jobs are being eliminated by the force of globalization which is shifting lower skilled work to lower paid workers in the developing world.

It is clear from this chart what is going on around the world. The top 1% makes its money from capital investments and historically the return on capital exceeds economic growth. The next 9% are both the skilled workers and the educated professionals who are benefitting from the growth of knowledge industry. The medium skilled middle class in the developed world, from the 75th percentile through the 90th percentiles, are the ones who are seeing the smallest income gains. Their jobs are being eliminated by the force of globalization which is shifting lower skilled work to lower paid workers in the developing world.

The article points out, consistent with the above chart, that the income, including benefits, of the poorest 50% in the U.S. grew 23% in this same time period. So it really is the middle class which is hurting the most in the U.S. There are three basic ways of addressing this problem:

- The federal government can help by taking much stronger measures to boost the economy thereby creating more jobs as well as higher paying jobs. Tax reform, trade expansion, immigration reform and fiscal stability are what is needed to get this job done.

- The states can help by improving our K-12 education system to make sure that everyone acquires the basic academic skills, such as reading and math, which they will need to achieve their highest potential in life.

- All concerned and aware individuals (such as ourselves!) must constantly beat the drums to encourage young people to stay in school and take learning seriously.

America is “exceptional” because it is the strongest, freest, and wealthiest country the world has ever known. But our future success is by no means guaranteed. We have to constantly work for it and earn it!

Harnessing Market Forces versus Offsetting Market Forces

The economist Matthew Slaughter writes in today’s Wall Street Journal that ’High Trade’ Jobs Pay Higher Wages. He points out that the 22.9 million Americans who work for U.S. headquartered multinational companies made an average of $73,338 in 2011 compared with the overall average wage of about $55,000 that year. “Workers in multinational firms earn more, as global engagement fosters innovation and productivity growth.”

“There is a growing concern about stagnant or falling incomes, yet most of the measures proposed to deal with the issue – raising the minimum wage and reinstating unemployment benefits – purport to help workers by offsetting market forces. Less attention is given to harnessing market forces.”

This can be done by “liberalizing U.S. trade, investment, immigration and tax policies.” In other words, we need more trade agreements like NAFTA, which has been so successful in increasing trade in North America. We need more high skilled workers, both domestic and foreign. We need lower corporate tax rates to encourage multinational corporations to bring their trillions of dollars in overseas profits back home.

This can be done by “liberalizing U.S. trade, investment, immigration and tax policies.” In other words, we need more trade agreements like NAFTA, which has been so successful in increasing trade in North America. We need more high skilled workers, both domestic and foreign. We need lower corporate tax rates to encourage multinational corporations to bring their trillions of dollars in overseas profits back home.

We should always strive for a more equal society with less income inequality. But the best single way to do this is to create more opportunity by growing the economy, i.e. by harnessing market forces.

How To Address Inequality: A Summary

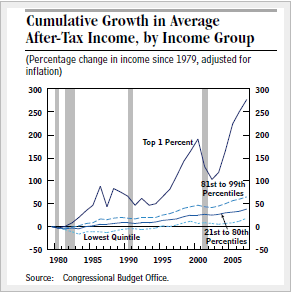

I have had many recent posts addressing the problem of income inequality in the United States and what can and should be done about it. Below is a chart, from the Congressional Budget office, which also appeared in my December 24, 2013 post. It shows that all income groups have made gains since 1980 but that higher income groups have gained the most.

This means that income inequality is increasing. The question is what to do about it. My own attitude is to try to provide more economic opportunity for low income people. How do we do this in the most effective way?

This means that income inequality is increasing. The question is what to do about it. My own attitude is to try to provide more economic opportunity for low income people. How do we do this in the most effective way?

- First and foremost by stimulating the private economy to grow faster and therefore to create more and higher paying jobs. This can be done with broad based tax reform (lowering tax rates offset by closing loopholes), fiscal stability achieved by eliminating deficit spending, expanded foreign trade for a more efficient global economy, and finally, immigration reform to give legal status to undocumented workers and allow more high skilled foreigners to immigrate to the U.S. Such measures as these require action by Congress and the President.

- Secondly, by improving human capital, meaning fixing underperforming schools, improving rundown neighborhoods, combatting inner city crime more effectively, providing at least part-time jobs to young people and combatting teenage pregnancy. Problems such as these are best addressed at the state and local level.

- Finally, providing more motivation for the unemployed and underemployed to find jobs and hold onto them. A very effective way to do this is with the federal Earned Income Tax Credit. It supplements the salary of working adults with children. New York City is conducting an experiment to see if a similar program will also motivate childless adults to try harder to find work and stay employed.

Conclusion: the best way to address inequality is to give people the best possible opportunity to obtain full time employment. This means 1) creating more jobs, 2) providing better qualified workers for all jobs and 3) motivating the unemployed more strongly to find jobs and hold on to them.

Government at all levels can help people find jobs, in one way or another, and therefore become more productive citizens. This will lead to a happier, healthier, and therefore a stronger society. All of us will benefit from this happening!