So says the Concord Coalition’s Robert Bixby. President Trump said in a recent interview on Fox News that he would like to have a balanced budget “eventually,” but not at the expense of higher spending for the military. The problem is, as Mr. Bixby points out, if we delay fiscal discipline in order to increase military spending, what else will we delay it for? Will we delay it for infrastructure spending or border security or tax cuts? Will we delay it to protect Social Security and Medicare?

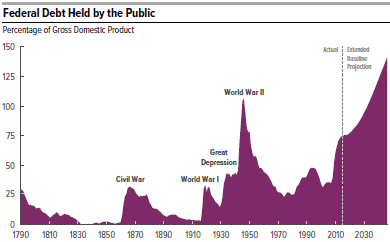

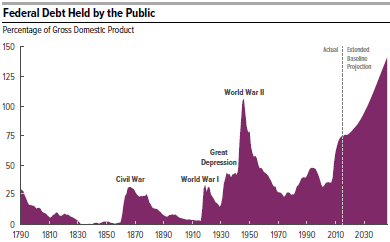

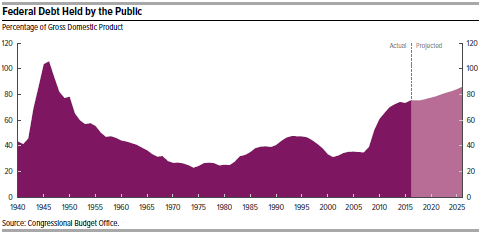

The Congressional Budget Office predicts (see chart) that, under current law, the public debt (on which we pay interest) will grow from 77% of GDP in 2017 to 89% of GDP in 2027. Furthermore, mandatory programs (Social Security, Medicare and Medicaid) will grow from 13% of GDP this year to 15.4% in 2027 while discretionary programs (everything else except interest payments) will fall from 6.3% of GDP today to 5.3% of GDP in 2027. Interest payments on the debt will grow from 1.4% of GDP ($270 billion) today to 2.7% of GDP ($768 billion) in 2027.

It turns out that it is possible to avoid this calamitous scenario in the following fiscally responsible way (see the attached table):

- Note that spending (outlays) is projected to increase from $3963 billion in 2017 to $6548 in 2027, which represents a 5% annual increase in spending every year.

- But also revenues (tax income) are projected to increase from $3404 billion in 2017 to $5140 billion in 2027.

- If spending growth could slow down from $3963 billion in 2017 to $5140 billion in 2027 (the projected amount of revenue in that year), the budget would then be balanced in 2027!

- It turns out that no budget cuts are required to accomplish this. In fact a calculation shows that simply limiting spending increases to 2.6% per year (rather than CBO’s projected increases of 5% per year) is sufficient to achieve this goal.

Conclusion. Above is outlined a plan to balance the budget over a ten year period without making any spending cuts! All that is needed is a modest amount of spending restraint!

A new report from the

A new report from the