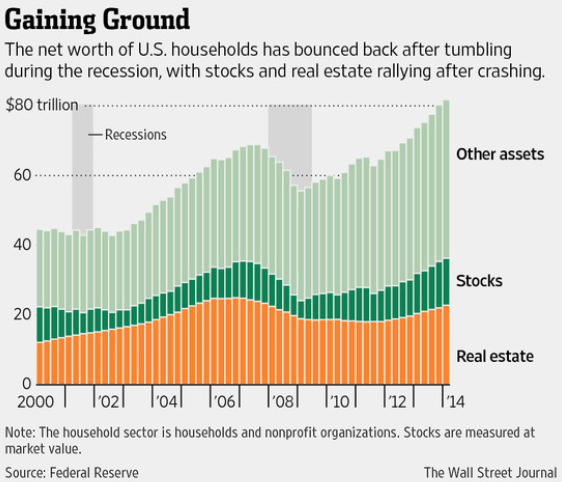

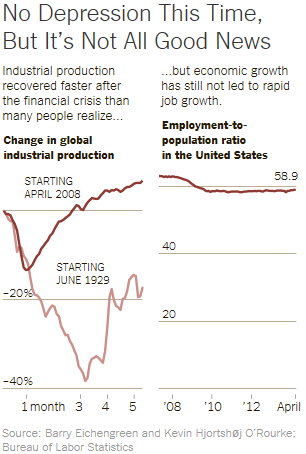

The Great Recession caused by the financial crisis ended in June 2009. In the intervening five years the U.S. economy has grown at the anemic annual rate of 2.2%. In an attempt to speed up growth the Fed has injected $4 trillion into the economy and kept short term interest rates near zero during this time period. Fed Chair Janet Yellen recently gave her semiannual report to Congress and, according to the American Enterprise Institute’s John Makin, “Fed Chair Yellen puts on a brave face.” She said that “If economy performance is disappointing, then the future path of interest rates likely would be more accommodative than currently anticipated.”

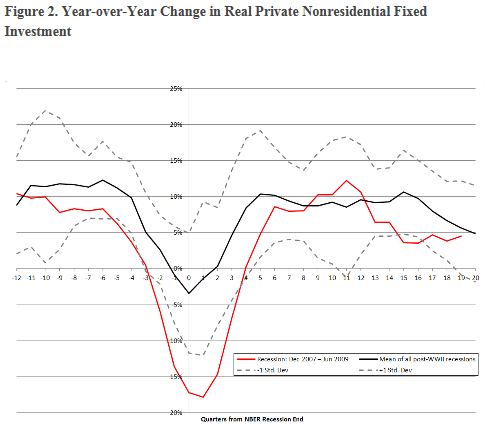

Mr. Makin adds that “Eventually the realization will dawn that the only way to get the economy moving again is to work on the supply side. Specifically, that means undertaking measures to boost investment and produce a rising capital stock which will boost labor productivity, hiring, and GDP growth without inflation.” He suggests that three measures to boost capital spending are:

Mr. Makin adds that “Eventually the realization will dawn that the only way to get the economy moving again is to work on the supply side. Specifically, that means undertaking measures to boost investment and produce a rising capital stock which will boost labor productivity, hiring, and GDP growth without inflation.” He suggests that three measures to boost capital spending are:

- Enactment of accelerated depreciation provisions and investment tax credits.

- A sharp reduction in the corporate tax rate from 35 to 15 percent to induce corporations to repatriate the $1.59 trillion in accumulated profits being held abroad.

- A concerted White House-led effort to set a clear, less burdensome path for healthcare and other regulatory measures as a means to reduce investment dampening uncertainty.

I would add a fourth measure:

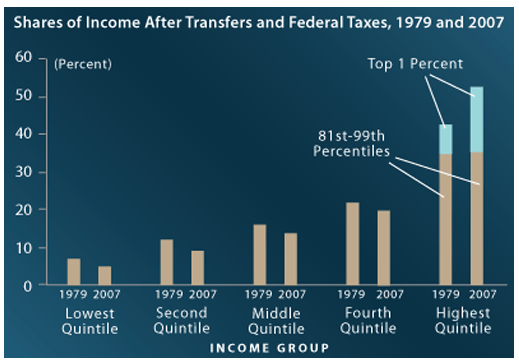

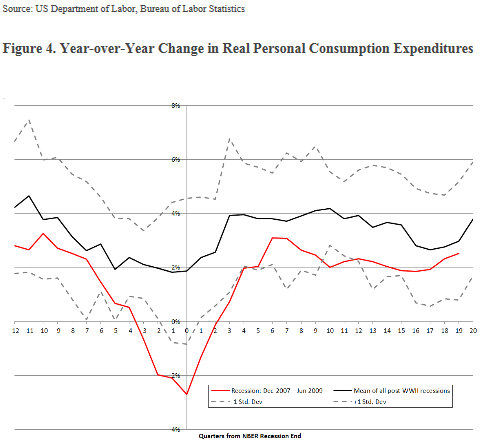

- An across the board lowering of individual tax rates (offset by closing loopholes and deductions which primarily benefit the wealthy) in order to boost personal consumption which has been highly depressed due to stagnant wage growth and high unemployment.

In other words there are clear and straightforward measures which our national leaders can take to speed up the economy. ‘If there is a will, there’s a way’ and incumbents should be held responsible for inaction come the elections in November!