I am just as personally embarrassed by President Donald Trump as most other people I know. He is rude towards other world leaders and especially our own allies. His destructive behavior endangers even his own policy initiatives. He was elected by blue-collar workers who feel left behind in today’s global economy. But how can he possibly lead others in implementing policies to help even his most avid supporters?

What is the Democratic Party doing about this? First of all, they are trying to stop acting so elitist toward the working class. But more fundamentally a new progressive social agenda apparently is emerging, here and here. It has many attractive features but there is one big thing missing, namely fiscal responsibility:

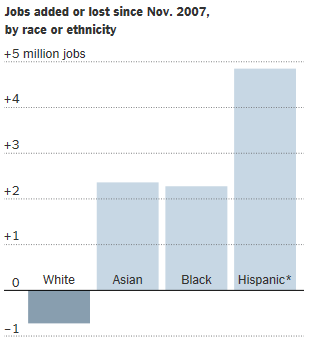

- A “public apprenticeship” jobs program. The idea here is to maintain the employment rate for prime-age workers without a bachelor’s degree at the 2000 level of 79%. This would require the creation of 4.4 million jobs, ideally at a living wage of $15 per hour plus Social Security and Medicare payroll taxes, and therefore at a wage of $36,000 per year. This would cost $158 billion per year.

- A universal child allowance of $250 per month. This would cost $190 billion per year, although half could be offset by consolidating less-efficient existing programs. This would cut child poverty by 40%.

- An expansion of the earned income tax credit. A family of four making $40,000 per year would get a tax credit of $6000 instead of the current credit of $2000. This would cost $1 trillion over ten years. The idea here is extra motivation to hold a job.

Conclusion. Who is opposed to creating millions of new living wage jobs to put the unemployed and underemployed back to work? Such a program would give our economy a huge boost. Who is opposed to cutting child poverty in half (or doing even better)? But how in the world would we make room for such new programs in the federal budget? With $500 billion annual deficit spending already, we need to curtail federal spending, not increase it.