It is well understood that income inequality is increasing in the U.S. and that there are lots of reasons for it. Globalization provides low cost goods from around the world and thus puts pressure on low-wage workers in our own country. Rapid technological advancement puts a high premium on educational attainment and skill acquisition and thus helps individuals who are highly motivated to succeed. The Great Recession and our slow recovery from it have held back the growth of employment and wages increases for middle- and lower-income workers.

Increasing income inequality is a pernicious social condition and has lots of unpleasant consequences. A new study of U.S. counties has shown that there is a strong correlation between more inequality in a particular geographical area and shorter average live spans. It is quite reasonable to expect that higher-income people will be more health conscious than lower- income people. Excessive inequality is bad for lots of reasons.

Increasing income inequality is a pernicious social condition and has lots of unpleasant consequences. A new study of U.S. counties has shown that there is a strong correlation between more inequality in a particular geographical area and shorter average live spans. It is quite reasonable to expect that higher-income people will be more health conscious than lower- income people. Excessive inequality is bad for lots of reasons.

The question is what we can do about it. Here are two good ways to address it:

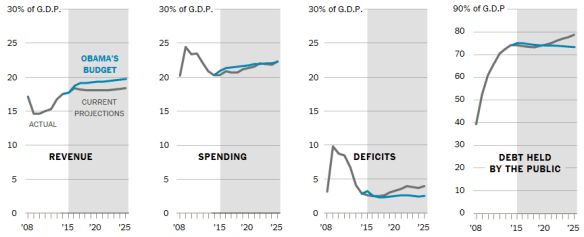

- Faster economic growth would help a lot. The American Enterprise Institute’s Michael Strain has recently proposed a fairly modest plan for increasing employment by cutting tax deductions for the wealthy, increasing the Earned Income Tax Credit for the poor and at the same time decreasing deficit spending. I have made a more substantial proposal along the same lines.

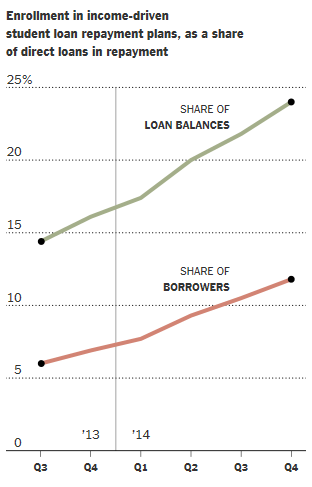

- Boost educational performance across the board. College-ready middle class kids will take care of themselves so the emphasis should be on the 70% of young adults who will not go to a four year college. There are lots of good jobs available for the highly skilled and so we need more career education in high school. We also need more early childhood education to prepare kids from low-income families to get off to a good start in elementary school.

Increasing economic growth and expanding educational opportunities for the non-college bound will require little, if any, new federal spending. Such policies as above are simply common sense ways to reduce income inequality and achieve a more inclusive society.