“If there is one thing that populists on the left and right can agree upon, it is disdain for crony capitalism. It is a distaste for the cesspool of Washington influence in which big-business lobbyists canoodle with lawmakers to get their way. It is anger at corporate welfare enriching America’s biggest companies at the expense of the little guy.” So says the economics journalist Neil Irwin in today’s New York Times, “Why we’re All Crony Capitalists, Like It or Not”.

Specifically he is talking about the current debate in Congress over whether or not the Export-Import Bank of the United States should be continued. It mostly helps big corporations like Boeing and General Electric finance sales to other countries. But there’s a trade off. If it shuts down, then American corporations will be at a disadvantage compared with international competitors who get help from their own governments.

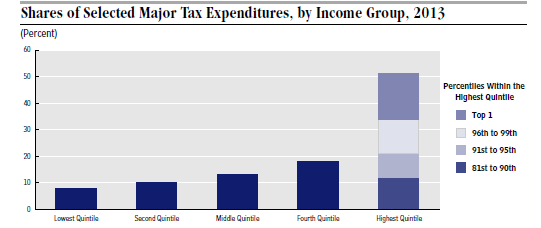

In fact, crony capitalism has a much wider scope than this. Each year deductions and loopholes in the U.S. tax code, referred to euphemistically as tax expenditures, total $1.2 trillion in lost tax revenue. As the above chart from the Congressional Budget Office shows, 50% of these tax reductions are enjoyed by the highest earning 20% of all U.S. households, with 30% of the benefits going to just the top 5%.

In fact, crony capitalism has a much wider scope than this. Each year deductions and loopholes in the U.S. tax code, referred to euphemistically as tax expenditures, total $1.2 trillion in lost tax revenue. As the above chart from the Congressional Budget Office shows, 50% of these tax reductions are enjoyed by the highest earning 20% of all U.S. households, with 30% of the benefits going to just the top 5%.

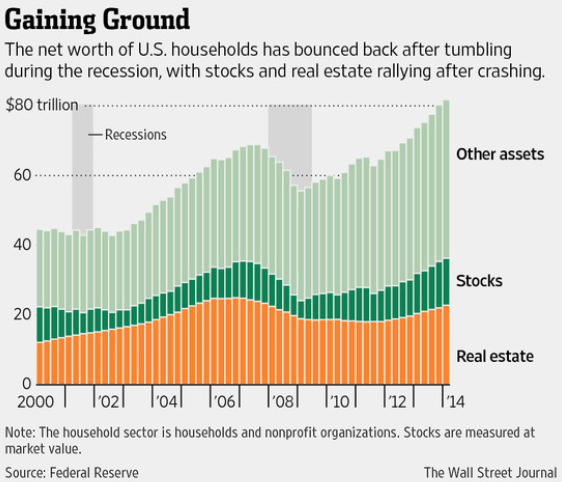

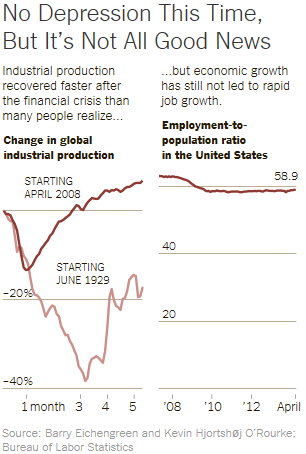

Many experts say that our stagnant economy is caused by a lack of consumer demand, in turn caused by the huge loss of wealth during the Great Recession. If lower and middle income people had more money, they would surely spend it and our economy would grow faster. This line of reasoning suggests a way forward!

We should enact fundamental, broad-based tax reform, whereby individual tax rates are lowered across the board, in a revenue neutral way, paid for by greatly shrinking the deductions and loopholes enjoyed by the top 5% of wage earners. The two-thirds of taxpayers who do not itemize their deductions will receive a correspondingly significant increase in income which they are most likely to spend.

A plan like this would not only boost the economy but also boost public morale by lessening inequality. A win, win plan!