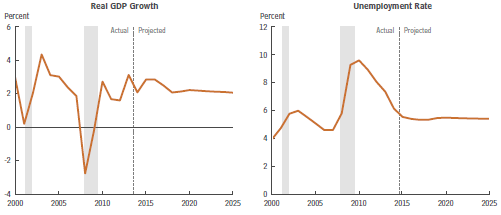

Our economy has been growing very slowly, about 2.2% per year on average, since the end of the Great Recession in June 2009. The Congressional Budget Office predicts that this slow growth will continue indefinitely, although with a brief respite of 2.9% growth in 2015 and 2016. The American Enterprise Institute predicts an even lower, less than 2% growth rate, going forward.

Here’s the essence of the overall problem:

Here’s the essence of the overall problem:

- Slow growth keeps the unemployment level high and also means minimal raises for employed workers The resulting economic slack leads to

- Low Inflation. But low inflation in turn means that the Federal Reserve can try to increase growth with quantitative easing and at the same time maintain

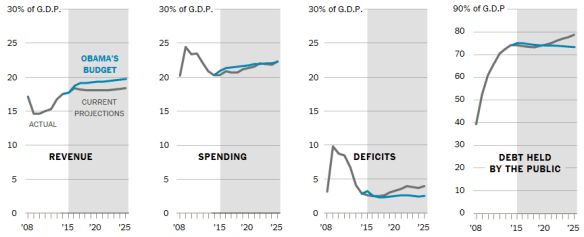

- Low Interest Rates to encourage borrowing. But an unfortunate side effect of low interest rates is that Congress can borrow at will and run up huge deficits without having to worry about paying interest on this “free” money. This leads to:

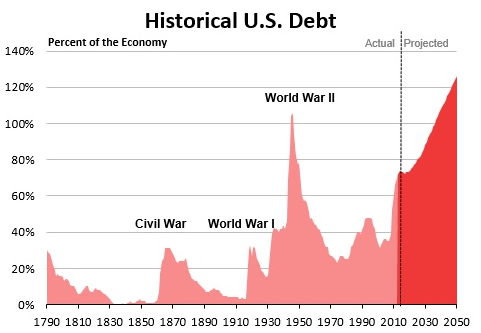

- Massive Debt. But what is going to happen when inflation does take off which is bound to happen eventually? Then the Fed will be forced to raise interest rates quickly and we will be stuck with huge interest payments on our accumulated debt. When this happens, interest payments plus ever growing entitlement spending will eat up most, if not all, of the federal budget. This will almost inevitably lead to a severe

- Fiscal Crisis.

FLOW CHART

Slow Growth->Low Inflation->Low Interest Rates->Massive Debt->Fiscal Crisis

Of course, there are alternative scenarios. Congress might become more responsible and cut spending and/or raise taxes. We might luck out, so to speak, with such prolonged slow growth that inflation stays low indefinitely and interest rates never increase. But slow growth is not pain free. There are 20 million unemployed or under-employed Americans who want to work and whose lives are much less satisfying as a result of being idle.

Isn’t it obvious that the best response to this slow growth fiscal trap is to adopt policies to make the economy grow faster? There are lots of things that could be done, many of which I addressed in my last post (https://itdoesnotaddup.com/2015/03/01/will-middle-class-economics-lift-us-out-of-secular-stagnation/) so I won’t repeat them here. But I’ll be coming back to them again and again in the future!