Thanks largely to Donald Trump the Republican presidential candidates are not taking the best approach to winning the White House in November. Instead of arguing with each other about who is the toughest on immigration or who is the most anti-establishment, they should be focusing on one issue where Republicans could have a big advantage: how to speed up our slow economic growth.

The Stanford economist, John Cochrane, makes very clear the value of doing this on his blog, The Grumpy Economist. Says Mr. Cochrane:

The Stanford economist, John Cochrane, makes very clear the value of doing this on his blog, The Grumpy Economist. Says Mr. Cochrane:

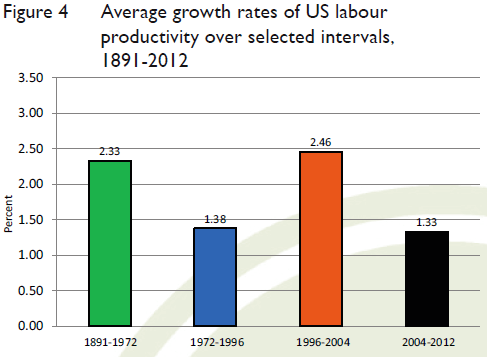

- From 1950 to 2000 the U.S. Economy grew at an average rate of 3.5% per year. Since 2000, it has grown at only half that rate, 1.7%.

- The average American is more than three times better off than his or her counterpart in 1950. Real GDP per person has risen from $16,000 in 1952 to over $50,000 today, both measured in 2009 dollars.

- If the U.S. economy had grown at 2% rather than 3.5% since 1950, income per person by 2000 would have been $23,000 not $50,000.

- Even these large numbers understate reality. GDP per capita growth does not capture the increase in life span – nearly ten years – or other improvements in the quality of life such as health and environmental gains which we have experienced.

Says Mr. Cochrane, “Next to this increase in the standard of living, nothing the candidates are talking about – monetary policy, Fed, fiscal stimulus, minimum wage hikes, pay equity, and so on, even comes close to what growth can bring ordinary Americans.” The important question then is how to speed up economic growth. Even though there are strong headwinds slowing down our modern economy, Mr. Cochrane has many excellent ideas on measures which can be taken to accomplish this. This will be the subject of my next post.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3