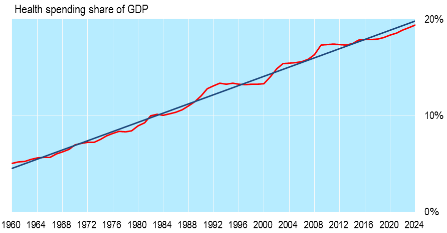

The GOP healthcare plan, both the House version and the Senate version, are highly imperfect. Yet they each do one thing which is badly needed. They put Medicaid on a budget. The current open-ended Medicaid program, whereby each state is reimbursed by the federal government for a percentage of its costs (the average is 53%), would be replaced by an annual per-capita payment which would increase only at the rate of inflation. It is estimated that the new per-capita budget would reduce federal Medicaid payments by about 25% after 10 years.

In order to get the federal debt under control, all three major entitlement programs, Social Security, Medicare and Medicaid, must be reined in and the current GOP plan would start doing this for Medicaid.

Reining in spending like this will force states to alter the way they regulate and administer Medicaid and the New York Times columnist Ron Lieber points out some of the challenges which will arise if Medicaid has to operate more efficiently:

• Nursing homes. One third of people who turn 65 will eventually end up in a nursing home. Furthermore, 62% of nursing home residents cannot pay for nursing homes on their own. The average annual cost of a semi=private room is $82,000.

• Home and community-based care. Medicaid is required to pay for nursing homes and may also pay for home and community-based care which is much less expensive and lets seniors stay in their own homes.

• Optional services for low-income people and the disabled. Optional services besides long-term home care include dental care for adults, therapy for disabled children at school, prosthetic limbs and prescription drugs.

Conclusion. Changing Medicaid from open-ended funding to a strict federal budget which grows at the rate of inflation will put a large burden on state Medicaid administrators and require some difficult tradeoffs to control spending. But this is absolutely essential as a first step towards controlling the rapid increase of entitlement spending.