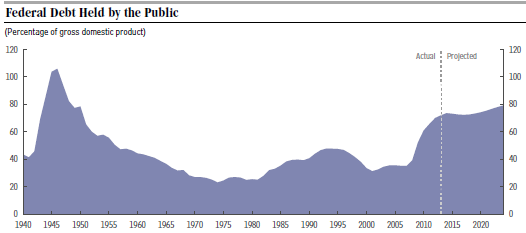

Most observers agree that the Congressional Budget Office is a reliable source for detailed, objective and nonpartisan information about the federal budget. Its frequent reports are cited by all sides in budget debates. Today I refer to the recent CBO publication, “The 2014 Long-Term Budget Outlook in 26 Slides.” In particular, one of its graphs entitled “Federal Debt Held by the Public” (pictured here) has a striking message.

Throughout history, the U.S. has had relatively large debt following each of its major wars, especially after World War II. But the debt has always declined relatively quickly, as a percentage of GDP, as the economy recovered and grew briskly. But now, in 2014, we are stuck with a huge debt which is projected (by CBO) to not shrink but rather to keep getting much worse. And furthermore, the so-called “Extended Baseline Projection” in the graph, is an optimistic projection which disregards several long-term trends such as mortality decline, possibly slower productivity growth, higher interest payments and likely growth of federal healthcare spending.

Throughout history, the U.S. has had relatively large debt following each of its major wars, especially after World War II. But the debt has always declined relatively quickly, as a percentage of GDP, as the economy recovered and grew briskly. But now, in 2014, we are stuck with a huge debt which is projected (by CBO) to not shrink but rather to keep getting much worse. And furthermore, the so-called “Extended Baseline Projection” in the graph, is an optimistic projection which disregards several long-term trends such as mortality decline, possibly slower productivity growth, higher interest payments and likely growth of federal healthcare spending.

How in the world will this huge debt problem be resolved in a favorable manner? Republicans don’t want to raise taxes and Democrats don’t want to cut spending, especially on entitlements. The only action taken in the last few years, under threat of not lifting the federal debt limit, was to implement a Sequester on discretionary spending. This helps but not nearly enough.

Recent budget agreements are not auspicious for future progress. A five year farm bill was passed last spring without significant cuts to either farm subsidies or food stamps. Highway spending was extended for a few months with a gimmick when what we really need to do is increase the federal gasoline tax. A $17 billion (over three years) increase for veteran’s health has just been approved when what we really need is an extensive overhaul of the Veterans Administration.

There are deficit hawks in Congress, on both sides of the aisle, but their numbers are too small to be effective. It is just very hard to vote no on spending measures when the pressure coming from special interest groups on all sides is to vote yes.

I am an eternal optimist by nature but I have a hard time visualizing a favorable outcome to our fiscal dilemma. I am arranging my own affairs accordingly.