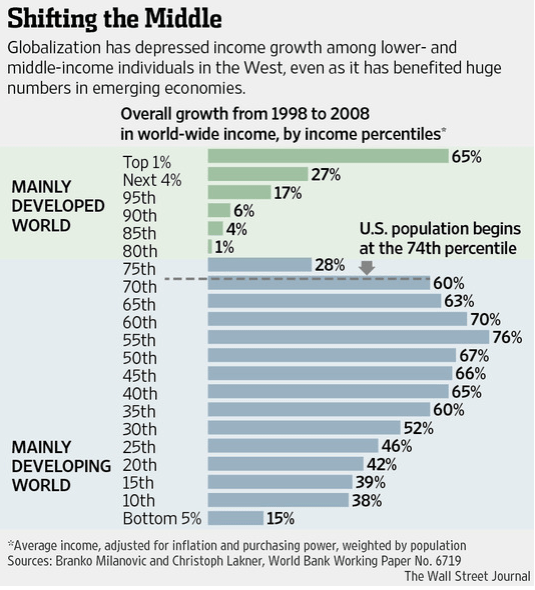

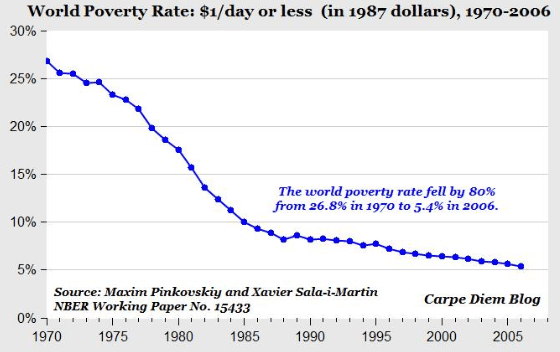

As I remind readers from time to time, this blog is concerned with America’s fundamental fiscal and economic problems: a slow economy, massive debt, and increasing income inequality. Largely because of these apparently intractable problems, more and more people are becoming pessimistic about the future of our country.

Although I am by nature an optimist, these matters weigh on me as well:

Although I am by nature an optimist, these matters weigh on me as well:

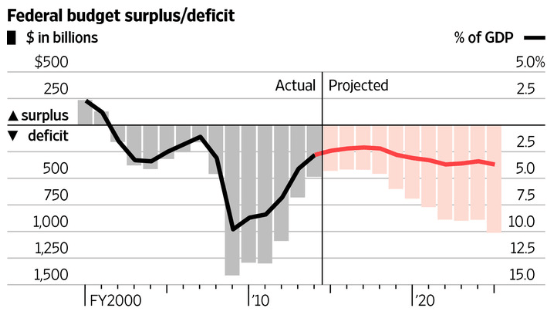

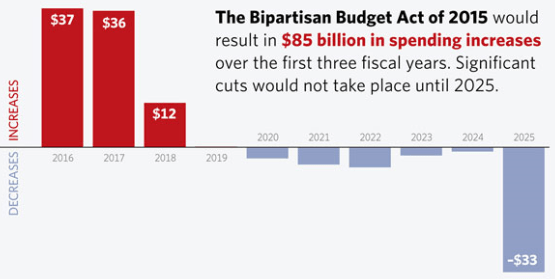

- The just introduced “Bipartisan Budget Act of 2015” is a sell-out to the status quo. It breaks the agreed upon sequester spending limits by $112 billion over two years with essentially no attempt to create long term spending restraint.

- As pointed out recently by the Washington Post’s Robert Samuelson, the presidential candidates are talking mainly about new entitlements (the Democrats) or tax cuts (the Republicans). In both cases this represents a flight from reality.

- Entitlements: The number of people aged 65 or older will increase from 15% of the population today to 22% of the population in 2040. The cost of Social Security, Medicare and Medicaid will jump from 6.5 % of GDP today to 14% of GDP in 2040. We simply must control these costs by raising eligibility ages for SS and Medicare and increasing premiums for wealthier recipients.

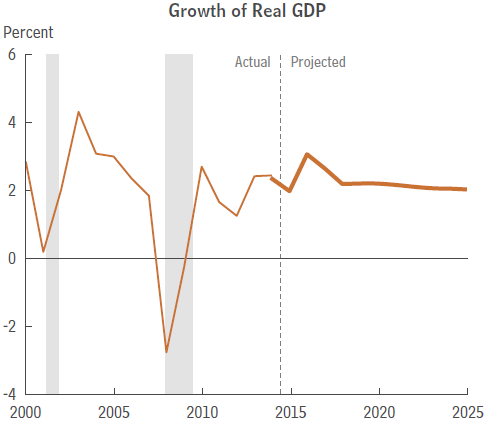

- Economic Growth: Annual growth has averaged only 2% of GDP since the end of the Great Recession in June 2009. Slow growth means weaker gains in wages, more unemployment and larger spending deficits. This can be fixed long term with honest tax reform, but not with unrealistic tax cuts.

Conclusion: Isn’t it obvious that we need political candidates who will speak forthrightly with the people about the need for addressing these humongous problems? Americans aren’t dumb. They will respond to straight talk from their supposed leaders.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3