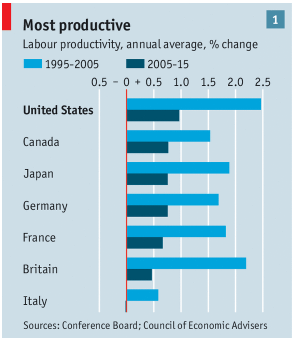

Both political parties, both presidential candidates, most prominent economists and economics journalists, in other words, most opinion makers, favor faster economic growth. I have had several recent posts on this topic, here and here, pointing out especially the need to increase the rate of growth of worker productivity which in turn is heavily influenced by the rate of new business investment.

One of the most valuable policy changes in this respect is tax reform, with lower marginal rates paid for by closing loopholes and shrinking deductions. The Republican House of Representatives has developed an excellent plan, “A Better Way,” which includes such extensive tax reform.

The American Enterprise Institute has recently analyzed the House plan and describes the positive impact it would have on our economy:

- Simplification. The seven current individual tax rates would be reduced to just three: 12%, 25% and 33%. All deductions would be eliminated except for mortgage interest and charitable contributions. The standard deduction would be almost doubled. A 50% exclusion for capital gains, dividends and interest income would lower those tax rates in half.

- Business taxes. The corporate tax rate would be cut from 35% to 20%, again by eliminating most deductions, and a territorial system adopted whereby taxes are only paid in the country where business is conducted. Immediate expensing for new investment would replace multiyear depreciation.

- Effects. Base broadening by eliminating deductions will add 6.5 million new taxpayers. The number of taxpayers taking the standard deduction will increase by 37 million (from 70% to 95%). Total tax revenue will decrease by $227 billion over ten years. The effective marginal tax rate is slightly lower for most income groups.

Conclusion. The overall lower tax rates will boost economic growth. The ten year loss of tax revenue, while relatively small, is still a detriment and should be eliminated by shrinking the remaining mortgage interest deduction (which primarily benefits the wealthy).