Peter G. Peterson is an 88 year old billionaire from Kearney NE. His Peterson Foundation has just established the Peterson Center on Healthcare whose purpose is “developing a comprehensive approach to finding existing innovative solutions in healthcare that improve quality and lower costs, and accelerating their adoption on a national scale.”

Working with Stanford University’s Clinical Excellence Research Center (CERC), the Peterson team looked at 15,000 single and multi-specialty physician practices around the country and winnowed the list to those practices which were in the top 25% on quality measures and in the lowest 25% in cost.

The second step was to identify the features of practices that help explain their exceptional performance. This led to the identification of the 11 most exceptional physician practices (see above map) around the country. The study found that total annual health spending was 58% lower for patients cared for by these exceptional practices compared to their national peers. Further analysis finds that nationwide adoption of the observed features of these practices would conservatively save $300 billion per year.

The second step was to identify the features of practices that help explain their exceptional performance. This led to the identification of the 11 most exceptional physician practices (see above map) around the country. The study found that total annual health spending was 58% lower for patients cared for by these exceptional practices compared to their national peers. Further analysis finds that nationwide adoption of the observed features of these practices would conservatively save $300 billion per year.

These extraordinary high-performing practices shared three basic features distinguishing them from others as follows:

- Their patient relationships are deeper: always on, conscientious observation, and complaints are gold.

- They have wider interaction with the healthcare system: responsible in-sourcing, staying close, and closing the loop.

- They have a team-based practice organization: upshifted staff roles, hived (highly collaborative) workstations, balanced compensation, and investment in people rather than space and equipment.

These findings debunk the myth that excellent value only exists by replicating methods used by very large health systems with an efficiency culture cultivated over many years. For example, “an independent three physician practice in a low-income neighborhood can be among the best.”

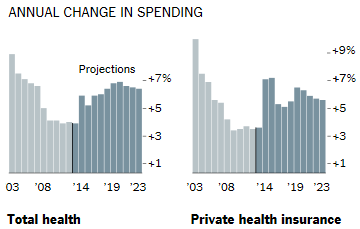

The Peterson Center on Healthcare is in the process of showing that free enterprise health care can achieve remarkable gains in both high quality and low cost. This is hugely important at a time when total U.S. spending on healthcare is already way too high and growing rapidly.

If private enterprise and the free market cannot figure out how to provide quality healthcare at a much lower cost, it is almost inevitable that the U.S. will eventually end up with a single-payer national healthcare system like most of the rest of the world.