Senator Fischer is up for re-election in 2018 and she starts out a recent fund raising letter (see below) as follows: “My goals are clear: stronger national defense, safer roads and bridges, healthcare that is accessible and affordable, protection of our fundamental liberties, less government, and a fairer, simpler tax code.” Here’s the breakdown:

- First, and most important: national security.

- Second, our roads and bridges must be repaired and rebuilt.

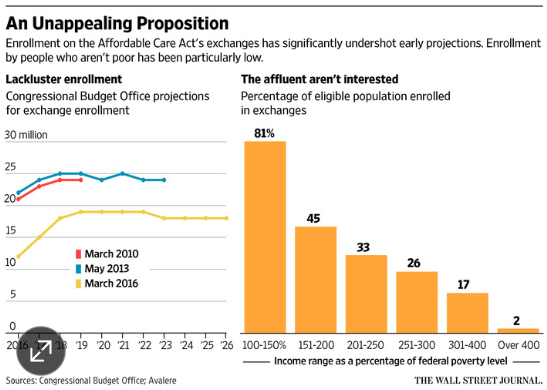

- Third, Obamacare must be repealed and replaced.

- Fourth, our fundamental liberties must be protected.

- Fifth, government must shrink and the tax code must be simpler and fairer.

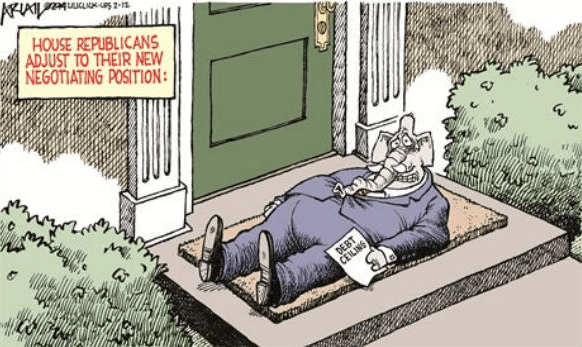

I don’t disagree with the specifics of any of these five goals but rather where the emphasis is placed. Her first two goals are to greatly increase spending for both the military and for infrastructure projects. Her last goal is to shrink the federal government which is a good idea but very hard to accomplish in practice.

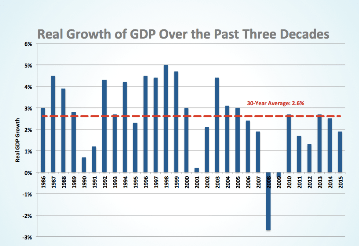

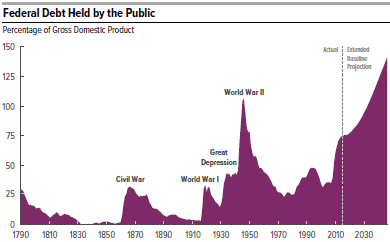

Here is the basic problem our national debt (the public part on which we pay interest) is now at 77% of GDP, the highest it has been since right after WWII, and steadily getting worse. Right now this approximately $14 trillion debt is essentially “free” money because interest rates are so low. But when interest rates inevitably rise to more normal levels, interest payments on the debt will soar by hundreds of billions of dollars per year and eat much more deeply into tax revenue.

It should be a very high priority for Congress to establish a plan to bring government spending more closely in line with tax revenue. I have previously described how this could be accomplished over a ten year period without cutting hardly anything but simply using restraint for spending increases.

Conclusion. If Senator Fisher feels that it is necessary to make big spending increases in areas such as national defense and infrastructure repair, then she should be equally adamant about the need to hold down the growth of government spending overall.

Follow me on Twitter

Follow me on Facebook