The readers of this blog know that I focus on what I consider to be the two biggest problems affecting our economy: 1) slow growth averaging just 2% per year since the end of the Great Recession and 2) our massive debt now equal to 75% of GDP (for the public part on which we pay interest) and predicted to keep growing steadily under current policy.

I have also made it clear that I am not pleased with the economic policies of either of the two main candidates for president, Hillary Clinton or Donald Trump. Whichever one of them is elected, our best hope for the future is that she or he will have to work with the Republican House of Representatives which has an excellent plan, “A Better Way,” for renewal.

But, of course, the next president will take up where Barack Obama has left off. The current issue of the Economist has an essay, “The Way Ahead,” in which Mr. Obama identifies several challenges:

But, of course, the next president will take up where Barack Obama has left off. The current issue of the Economist has an essay, “The Way Ahead,” in which Mr. Obama identifies several challenges:

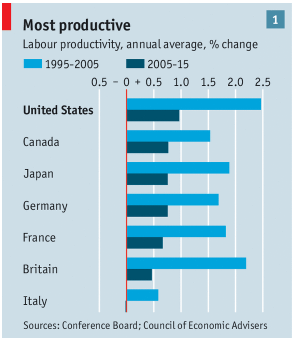

- Boosting productivity growth. The above chart from his essay shows how much productivity growth has declined in the last ten years. He claims that the corresponding lack of investment is caused by an anti-tax ideology which rejects new funding for public projects, which in turn can be blamed on a fixation on deficits in spite of our skyrocketing debt problem. The House plan correctly identifies tax and regulatory reform as what are needed for progress.

- Combatting rising inequality. An expanded Earned Income Tax Credit will definitely help here but mainly what is needed is overall faster economic growth.

- Insuring that everyone who wants a job can get one. Wage insurance and better retraining programs for laid off workers are good ideas. But again, faster economic growth is what is really needed.

- Building a resilient economy which is primed for future growth. Mr. Obama says that “America should also do more to prepare for future shocks before they occur.” This is exactly why we urgently need to start shrinking our debt now before the shock of higher interest rates leads to huge increases in interest payments on our rapidly growing debt.

Conclusion. Let’s give Mr. Obama credit for avoiding another depression after the Financial Crisis. But his poor policies are to blame for the very slow rate of recovery ever since.

Follow me on Twitter

Follow me on Facebook