In the national elections this year four states: Alaska, Arkansas, Nebraska and South Dakota raised their state minimum wage rates above the national rate of $7.25 per hour and, at the same time, elected Republicans to the U.S. Senate, in three cases replacing Democratic incumbents. Does this represent contradictory behavior by the voters?

The American Enterprise Institute’s James Pethokoukis recently reported (see above) that the U.S. has the third highest rate of billionaire entrepreneurs behind only Hong Kong and Israel, as well as by far the most billionaires over all. These are the high-impact innovators like Bill Gates, Steve Jobs and Mark Zuckerberg and the Google Guys.

The American Enterprise Institute’s James Pethokoukis recently reported (see above) that the U.S. has the third highest rate of billionaire entrepreneurs behind only Hong Kong and Israel, as well as by far the most billionaires over all. These are the high-impact innovators like Bill Gates, Steve Jobs and Mark Zuckerberg and the Google Guys.

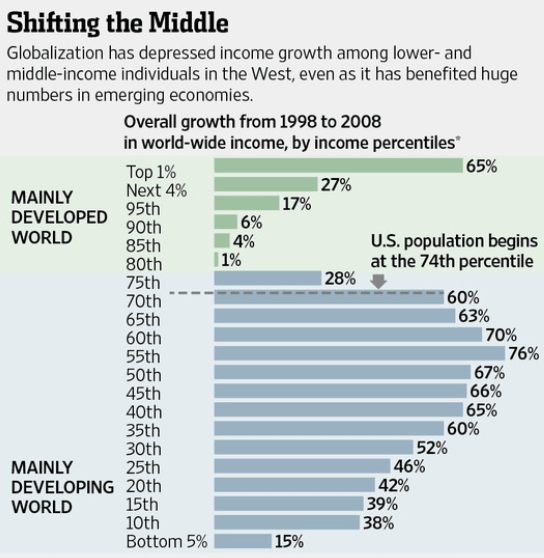

These observations are put in context by the Manhattan Institute’s Scott Winship who recently reported that “Inequality Does Not Reduce Prosperity.” Here is a summary of his findings:

- Across the developed world, countries with more inequality tend to have higher living standards.

- Larger increases in inequality correspond with sharper rises in living standards for the middle class and poor alike.

- In developed nations, greater inequality tends to accompany stronger economic growth.

- American income inequality below the top 1 percent is of the same magnitude as that of our rich-country peers in continental Europe and the Anglosphere.

- In the English-speaking world, income concentration at the top is higher than in most of continental Europe; in the U.S., income concentration is higher than in the rest of the Anglosphere.

- With the exception of a few small countries with special situations, America’s middle class enjoys living standards as high as, or higher than, any other nation.

- America’s poor have higher living standards than their counterparts across much of Europe and the Anglosphere.

Conclusion: Americans are fair-minded and would like to help the working poor do better. But Americans also appreciate the value of innovation and entrepreneurship. When there is a tradeoff between increasing prosperity and reducing inequality, greater prosperity comes first.