As I have previously stated, I voted for Hillary Clinton because Donald Trump is so crude and sleazy even though our country will now greatly benefit from the change which Mr. Trump represents. This is the way the political process often works.

Consider that after eight years of George Bush we had:

Consider that after eight years of George Bush we had:

- Ongoing war in Iraq and Afghanistan, of which the Iraq war was an unnecessary mistake.

- $2.5 trillion of additional debt, even after Mr. Bush started out with a budget surplus, compliments of Bill Clinton.

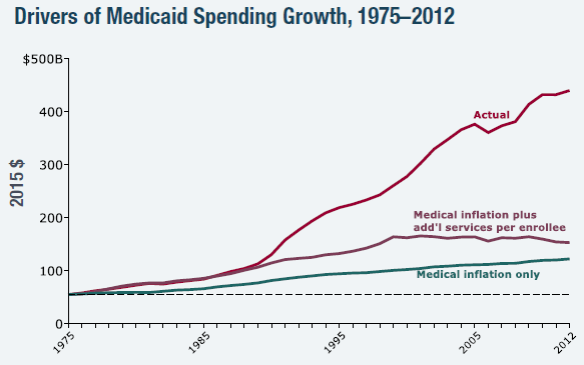

- An expensive new Medicare Part D prescription drug plan which just makes overall Medicare even less affordable than it already is.

- The Financial Crisis of 2007-2008 which the Bush Administration could have seen coming if they had been more vigilant.

Under such political circumstances, the 2008 election of the Democratic nominee, Barack Obama, over the Republican nominee, John McCain, was almost inevitable. But then in the next eight years we have experienced:

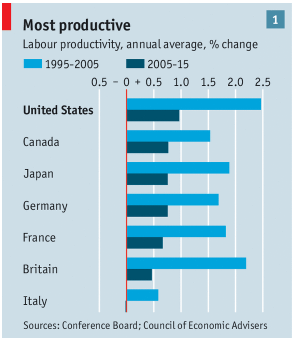

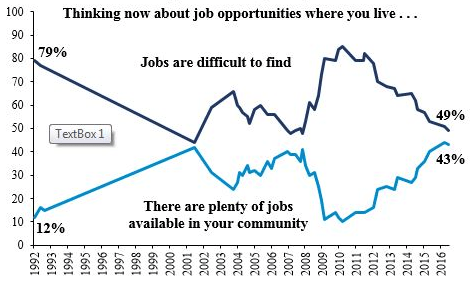

- Slow economic growth averaging only 2% per year, ever since the end of the Great Recession in June 2009. The unemployment rate has fallen to 4.9% but there is still a lot of slack in the labor market which holds wages down. This is the main reason for the huge support Mr. Trump had from white blue-collar workers in the election.

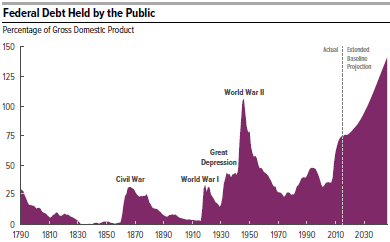

- Massive debt, now 76% of GDP (for the public debt on which we pay interest), the highest since right after WWII and double the debt in January 2009 when Mr. Obama entered office. Such a high debt level means greatly increased interest payments as soon as interest rates go up which they are likely to do anytime. The high annual deficits contributing to the debt mean little budget flexibility for new programs.

Conclusion. Democrats like to say that slow economic growth is “the new normal” which can only be overturned with budget busting new fiscal stimulus. This is a pessimistic point of view which refuses to consider other alternatives. This is what led to Ms. Clinton’s defeat on November 8.