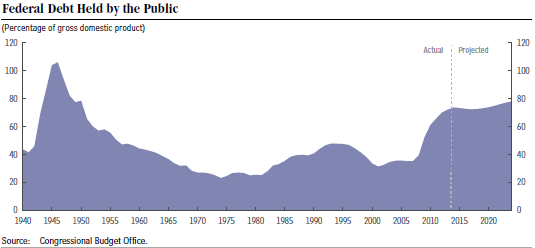

The deficit for fiscal year 2014-2015 just ended is “only” $483 billion, about 2.7% of current GDP, and some observers are saying this means that our deficit and debt problems are now under control and we should stop fretting so much about them.

There is a nonpartisan outfit in Washington DC, “Fix the Debt,” which focuses on this very problem and they’re saying not so fast. In their document, “Common Myths about the Debt,” they debunk several false impressions about the national debt:

There is a nonpartisan outfit in Washington DC, “Fix the Debt,” which focuses on this very problem and they’re saying not so fast. In their document, “Common Myths about the Debt,” they debunk several false impressions about the national debt:

- Myth: Deficit levels are falling and therefore debt is no longer a concern.

- Fact: Over the next decade our debt is on track to grow about $8 trillion (see above chart). Its growth will accelerate after 2018 and will exceed the size of the entire economy by 2035.

- Myth: Deficit reduction is just code for austerity which will ultimately hurt the economy.

Fact: A comprehensive and gradual deficit reduction plan can replace austerity with targeted and pro-growth reforms which promote economic recovery and accelerate long-term wage growth. - Myth: Deficit reduction will harm low-income and vulnerable populations.

- Fact: Every recent bipartisan deficit reduction plan has included progressive reforms that ask more from those who can afford it and protect low-income programs.

- Myth: The debt can be solved with faster economic growth.

- Fact: Economic growth must be part of the solution, but it can’t solve the debt problem alone. Productivity growth would have to be 50% higher over the next quarter century just to hold debt to its current record-high levels.

- Myth: Taxing the wealthy more will solve the debt problem.

- Fact: Our debt problems are too large, and the top 1% too few, to solve the entire problem by raising taxes on the wealthy.

Conclusion: Our debt problem is so large that it can only be solved by stern measures, such as tax reform, including reducing tax breaks, and also spending reform to slow the growth of entitlement programs. Stay tuned for further discussion of this critical problem!