The City of Omaha is now considering building a Streetcar System for an estimated cost of $156 million. Both of the two mayoral candidates have endorsed this proposal.

Here are the basic facts about the project:

Here are the basic facts about the project:

- It would run from TD Ameritrade Park in downtown Omaha to 42nd and Farnam Streets in midtown Omaha, a distance of about four miles. It would cost about $7.5 million per year to operate the line and would generate about $700,000 a year in annual revenue with a fare of $1.25 per ride. Adding a fee of $1.50 per ticket per College World Series event (at TD Ameritrade Park) would generate about $500,000 per year in additional income.

- The financial assessment of the project by HDR suggests that the Federal Transit Administration could be asked for a grant of $78 million, or one-half of the total cost. The FTA is already contributing $15 million towards a $30 million Bus Rapid Transit system along Dodge Street approved by the City Council. The BRT involves 27 sleek, modern bus stop shelters along the route at a cost of $260,000 each.

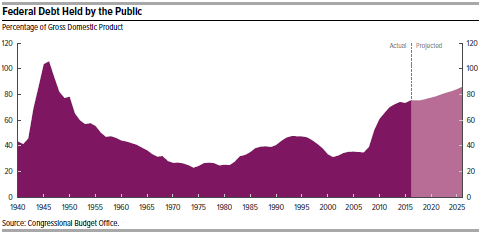

- The FTA has an annual budget of $19 billion. The Trump Administration is asking for a $2.4 billion cut in the FTA budget for 2018. Congress has not yet taken any action on the Trump Budget proposal. But the FTA budget is clearly funding extravagant local projects around the country and is ripe for a major budget cut.

Conclusion. Omaha is simply not large enough, nor with a sufficiently dense population base, to support a downtown street car system aimed at the tourist trade. It could only be financed with massive federal support at a time when the federal government is rightly trying to cut back on unnecessary and wasteful spending. Don’t do it, Omaha!

A new report from the

A new report from the