“The single biggest threat to our national security is our debt”

Admiral Mike Mullen, former Chairman of the Joint Chiefs of Staff

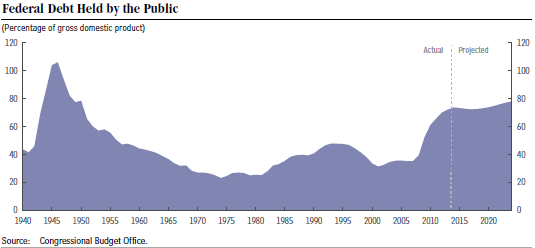

My last blog, “Why the National Debt Is Such a Threat to the U.S.” observes that our debt is very large by historical standards and will just keep getting worse under current policies now in effect. This has many severe consequences for the well-being of our country.

What do we do about it? We have to shrink the size of our annual deficits which are continuing to make the debt bigger and bigger. The deficit for the 2014-2015 budget year just ended is $483 billion which is 2.8% of GDP. Since our economy has been growing at a rate of only 2.2% for the past five years, this means that the debt is still growing faster than the economy. We have to do better than this.

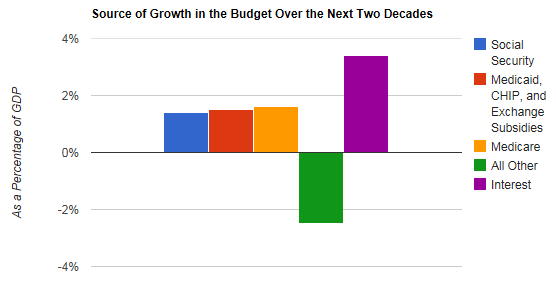

The above chart from the Congressional Budget Office shows that the main contributors to the deficit, and therefore also the debt, over the next 20 years, will be entitlements (Social Security, Medicare and Medicaid) and interest payments on the debt. All other programs, i.e. almost all of traditional federal spending, will decrease as a percentage of GDP.

The above chart from the Congressional Budget Office shows that the main contributors to the deficit, and therefore also the debt, over the next 20 years, will be entitlements (Social Security, Medicare and Medicaid) and interest payments on the debt. All other programs, i.e. almost all of traditional federal spending, will decrease as a percentage of GDP.

This means that there are just two basic ways to solve our debt problem: trim entitlement spending and/or increase government revenue. We’ll need to do both. Furthermore, it is unrealistic to expect middle-income and lower-income people to pay higher taxes when their wages have been stagnant for many years. New tax revenue will have to come from the wealthy including upper-income wage earners. The best way to do this is by cutting back on the annual $1.2 trillion in loopholes and deductions built into the tax code.

Only one Senate candidate from Nebraska is willing to both trim entitlement spending and raise additional tax revenue: Jim Jenkins, a registered independent from Calloway. The Democratic candidate, David Domina, will not support any significant reining in of entitlement spending. The Republican candidate, Ben Sasse, is too beholden to wealthy contributors to be willing to raise their taxes by cutting back on their tax deductions.

Only one Senate candidate from Nebraska is willing to both trim entitlement spending and raise additional tax revenue: Jim Jenkins, a registered independent from Calloway. The Democratic candidate, David Domina, will not support any significant reining in of entitlement spending. The Republican candidate, Ben Sasse, is too beholden to wealthy contributors to be willing to raise their taxes by cutting back on their tax deductions.

We badly need elected representatives in Washington who will make it their top priority to “fix the debt.” Jim Jenkins is such a person. I hope you will vote for him!