It has been widely reported that medium household incomes were up 5.2% to $56,500 in 2015. Furthermore the lower income quintiles have gained the most. This is very good news.

But this new peak is below the previous peak of $57,400 in 2007, before the Great Recession started, which in turn is below the absolute peak of $57,900 in 1999. Now look at economic growth more broadly.

But this new peak is below the previous peak of $57,400 in 2007, before the Great Recession started, which in turn is below the absolute peak of $57,900 in 1999. Now look at economic growth more broadly.

The second chart shows the annual rate of real (i.e. inflation adjusted) GDP growth, by expansion period, all the way back to 1949. What is most striking is that growth has been steadily decreasing over this entire time period and is now down to an average rate of just 2% during the current recovery. There is really only one way to reverse this steep decline. It is to return to proven fundamentals as well explained by the economist, John Cochrane. In summary:

The second chart shows the annual rate of real (i.e. inflation adjusted) GDP growth, by expansion period, all the way back to 1949. What is most striking is that growth has been steadily decreasing over this entire time period and is now down to an average rate of just 2% during the current recovery. There is really only one way to reverse this steep decline. It is to return to proven fundamentals as well explained by the economist, John Cochrane. In summary:

- There is only one source of growth. Nothing other than productivity matters in the long run. And, unfortunately, the business investment which leads to gains in productivity is way down.

- The vast expansion in regulation is the most obvious change in public policy accompanying America’s growth slowdown.

- The basic structure of growth-oriented tax reform is lower marginal rates paid for by removing exemptions and loopholes. A high corporate tax rate hurts workers more than anyone else.

- Solving our immigration problem would turn 11 million illegal immigrants into productive citizens. Guest worker and e-Verify enforcement are fixable problems.

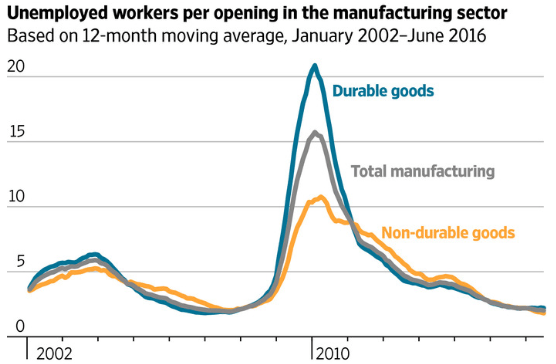

- International trade with strict reciprocity between trading partners will benefit almost everyone. Manufacturing workers who lose their jobs to foreign competition need robust retraining programs for the many manufacturing jobs which still exist.

Conclusion. Faster economic growth is imminently doable. Just follow tried and true economic fundamentals!